Summary:

The Reserve Bank of Australia (RBA) maintained the cash rate at 3.6% during its October 2025 meeting, reflecting a cautious but constructive stance amid signs of recovery in consumption and labour markets. Governor Michele Bullock reiterated the Bank’s data-dependent approach, noting that while inflation remains within the 2–3% target band, underlying pressures persist in services and housing. The RBA provided no forward guidance, emphasizing flexibility as it awaits updated CPI and labour market data in November.

Bond markets across Australia and the U.S. rallied as yields fell sharply, signalling rising investor caution and expectations of policy easing. In Australia, the RBA cash rate held steady at 3.60%, but the 3-month BBSW slipped to 3.57%, while government bond yields tumbled across maturities — the 3-year yield dropped 28 bps to 3.31%, 10-year fell 27 bps to 4.10%, and 30-year eased 17 bps to 4.84%. In the U.S., Treasury yields also declined, with the 2-year at 3.43%, 10-year at 3.98%, and 30-year at 4.58%, as markets priced in the likelihood of slower global growth and future rate cuts.

Domestically, attention turned to Australia’s weakening labour market, with unemployment rising to 4.5% in September from 4.2%, reflecting higher workforce participation. This softening eased concerns about wage-driven inflation, prompting markets to assign a 75% probability to an RBA rate cut in November. Governor Michele Bullock reiterated that the current stance is “a little on the tight side,” consistent with a neutral rate between 3% and 3.25%.

A dovish pivot by the RBA could relieve pressure on indebted households, corporate borrowers, and property markets, where signs of stabilisation are emerging. However, global uncertainties — particularly the escalating U.S.–China trade tensions over rare earths — continue to cloud the economic outlook

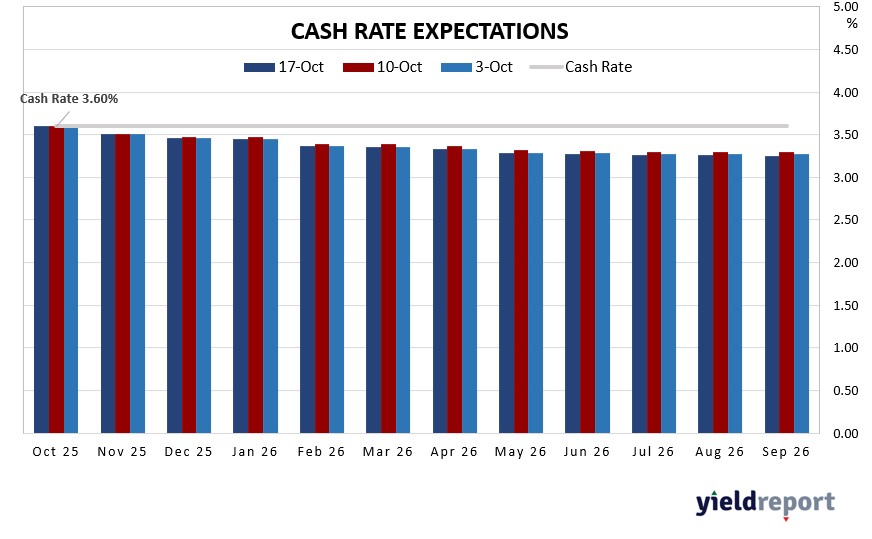

Figure 1: Market Expectation on Cash Rate

CASH ACCOUNT

Product Interest

Rate p.a.Notes AMP Saver Account 4.45% To earn the bonus rate, you must grow your account balance by at least $250 (excluding interest earned) by the end of each calendar month. Applies to balances up to $500,000. ANZ Premium 0.05% $10,000 - $249,999 ANZ Progress Saver 3.15% To earn the bonus rate, you must deposit at least $10 in one transaction and not make any withdrawals or transfers during the month.Applies to balances up to $500,000 Arab Bank Online Savings 4.55% No minimum deposit or monthly conditions to earn interest.Applies to balances up to $499,999 for the higher rate Bankwest Hero Saver 4.00% Variable Hero rate on eligible balances up to $250,000.99. CBA NetBank Saver 4.45% 4.45% p.a. for the first 5 months (includes a 2.90% p.a. fixed bonus margin above the standard variable rate of 1.55% p.a. CBA Goal Saver Account 4.25% 4.25% p.a. when you grow your balance each calendar month (excluding interest and transactions initiated by the bank) Heritage Online Saver 4.00% get a 4 month Bonus Intro Rate* available for new members on balances up to $100,000. ING Savings Accelerator 4.70% To earn the bonus rate, you must deposit at least $1,000 into a personal ING account, make 5 eligible transactions with a linked Orange Everyday account, and grow the balance each month Macquarie CMA 2.00% Interest rates vary based on account balance tiers.applies $10,000,000 and above: ME Online Savings 3.60% Bonus interest applies to balances up to $250,000. NAB iSaver 4.45% for the first 4 months (includes a 3.15% p.a. fixed bonus margin above the standard variable rate of 1.25% p.a.Available to new customers or those who haven't held a NAB iSaver in the last 12 months. NAB Reward Saver 4.15% includes a 0.10% p.a. variable base rate and a 4.00% p.a. variable bonus rate).To earn the bonus rate, you must make at least one deposit on or before the second last banking day and no withdrawals. Rabobank PremiumSaver 4.65% On balances to $250,000. Balance increased by $200 a month. RAMS Saver Account 1.40% On balances to $500,000. Minimum $200 deposit each month with no withdrawals. Suncorp Growth Saver 4.30% Earn 4.30% p.a. Growth Saver bonus interest each month you grow your net balance by $200 or more (excluding interest) and make no more than one withdrawal. ubank Save Account 5.00% All you need to do is have a Spend account and deposit $500+ per month into any Spend, Bills, or Save accounts (not including internal transfers) to get the bonus interest rate. Easy. Up Savers Account 4.30% To earn the bonus rate, you must deposit at least $200 each month and make no withdrawals. Westpac eSaver 4.25% Fixed rate for the first 5 months for new eSaver customers.