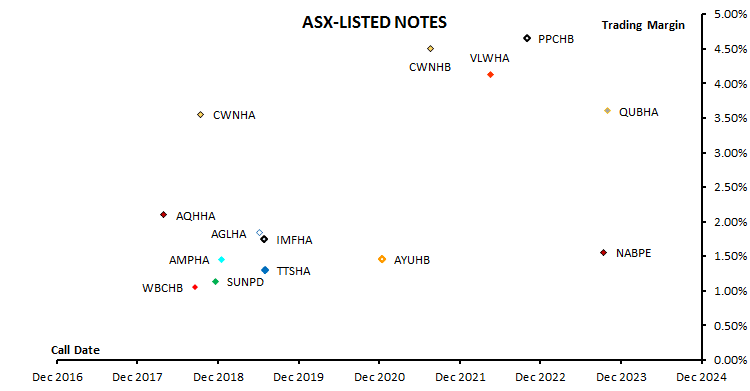

Trading margins of ASX-listed notes and bonds slipped this week and the median trading margin fell from 1.80% to 1.75%. Excluding securities which are close to maturity, the largest moves came from Tatts Bonds (ASX code: TTSHA, +45bps) and Crown Notes 1 (ASX code: CWNHA, 116bps) and Crown Notes 2 (ASX code: CWNHB, +52bps). Crown has been in the news for all the wrong reasons lately so it is no surprise to see investors sell off its shares and require a higher yield from its debt securities.

N.B. Charts of ASX-listed notes are now no longer divided by Financial/Non-financial categories.

The current 3 month BBSW rate is around 1.70%. Add the trading margin from the above chart or from the tables to 1.70% for a gross return per annum in the absence of BBSW rate changes. The gross return may contain imputation credits. BBSW typically is around 15bps (average since 1990) more than the RBA rate.

ASX LISTED FLOATING RATE NOTES

| COMPANY $100 Face Val | CODE | BOND TYPE | MATURITY | ISSUE MARGIN | TRADING MARGIN | Δ WEEK | WEEK CLOSE | RUNNING YIELD** |

|---|---|---|---|---|---|---|---|---|

| AGL | AGLHA | Sub Note | 8-Jun-19 | 3.80% | 1.84% | 0.04% | 103.76 | 5.33% |

| AMP | AMPHA | Sub Note II | 18-Dec-18 | 2.65% | 0.34% | -0.69% | 103.05 | 4.24% |

| APT Pipelines | AQHHA | Sub Note | 31-Mar-18 | 4.50% | 2.10% | -0.06% | 101.40 | 6.13% |

| Australian Unity | AYUHB | Unsub. Bond | 15-Dec-20 | 2.80% | 1.46% | 0.31% | 104.00 | 4.33% |

| Crown | CWNHA | Sub Note | 14-Sep-18 | 5.00% | 3.55% | 1.16% | 102.01 | 6.61% |

| Crown | CWNHB | Sub Note | 23-Jul-21 | 4.00% | 4.50% | 0.52% | 99.30 | 5.77% |

| Bentham IMF | IMFHA | Bond | 30-Jun-19 | 4.20% | 1.75% | -0.08% | 104.20 | 5.67% |

| Nat Aust Bank | NABPE | Sub Note T2 | 20-Jun-23 | 2.20% | 1.56% | -0.01% | 103.65 | 3.77% |

| Qube Holdings | QUBHA | Sub Note | 5-Oct-23 | 3.90% | 3.60% | -0.03% | 107.25 | 5.23% |

| Suncorp-Metway | SUNPD | Sub NoteI T2 | 21-Nov-18 | 2.85% | 1.14% | 0.10% | 102.60 | 4.47% |

| Tatts | TTSHA | Snr. Bond | 5-Jul-19 | 3.10% | 1.30% | 0.45% | 103.20 | 4.66% |

| Villa World | VLWHA | Snr. Bond | 21-Apr-22 | 4.75% | 4.13% | 0.06% | 102.50 | 6.29% |

| Westpac | WBCHB | Sub Note T2 | 22-Aug-18 | 2.30% | 1.06% | -0.17% | 101.70 | 3.96% |