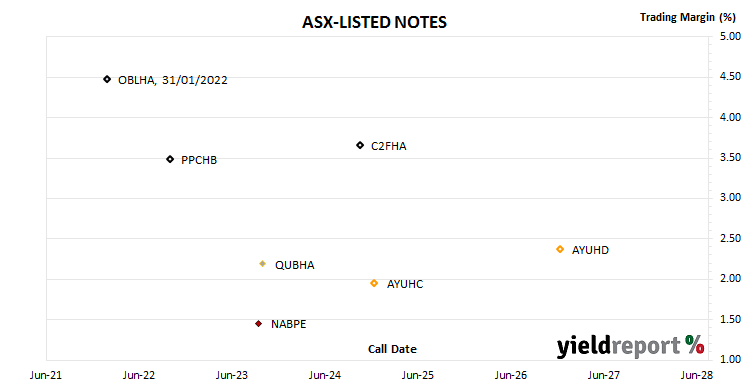

Summary: Trading margins relatively stable; Centuria begin trading.

Trading margins of ASX-listed notes and bonds remained relatively stable this week and movements were generally small in both directions. None of the securities’ margins exhibited particularly notable movements.

Centuria Capital Number 2 Fund Secured Notes (ASX code: C2FHA) began trading on Wednesday. It closed the week with a 2% premium to its face value.

Crown Subordinated Notes 2 (ASX code: CWNHB) are not displayed.

The current 3-month BBSW rate is just a few basis points above zero. Add the trading margin from the above chart or from the tables to this figure for an estimate of the gross return per annum in the absence of BBSW rate changes. The gross return may contain imputation credits. BBSW typically is around 15bps (average since 1990) more than the RBA rate.

ASX-LISTED FLOATING RATE NOTES

| COMPANY | CODE | BOND TYPE | MATURITY | ISSUE MARGIN | TRADING MARGIN | Δ WEEK | WEEK CLOSE | RUNNING YIELD** |

|---|---|---|---|---|---|---|---|---|

| Crown | CWNHB | Sub. Note | 23-Jul-21 | 4.00% | 14.61% | -0.91% | 97.98 | 4.14% |

| Omni Bridgeway | OBLHA | Bond | 31-Jan-22 | 4.20% | 4.47% | 0.11% | 100.00 | 4.25% |

| Centuria Capital | C2FHA | Sec. Note | 20-Apr-26 | 4.25% | 3.48% | 0.05% | 101.90 | 4.61% |

| Peet | PPCHB | Bond | 5-Oct-22 | 3.65% | 1.45% | -0.03% | 101.95 | 2.20% |

| Nat. Aust. Bank | NABPE | Sub. Note Tier 2 | 20-Jun-23 | 2.20% | 2.19% | 0.08% | 104.20 | 3.79% |

| Qube Holdings | QUBHA | Sub. Note | 5-Oct-23 | 3.90% | 3.66% | 102.00 | 4.21% | |

| Australian Unity | AYUHC | Bond Series C | 15-Dec-24 | 2.00% | 1.96% | -0.03% | 100.23 | 2.04% |

| Australian Unity | AYUHD | Bond Series D | 15-Dec-26 | 2.15% | 2.37% | 0.09% | 99.00 | 2.21% |