| Close | Previous Close | Change | |

|---|---|---|---|

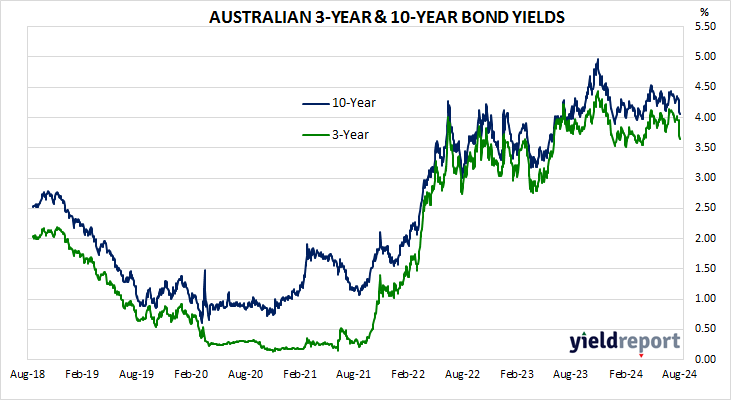

| Australia 3-year bond* (%) | 3.64 | 3.70 | -0.06 |

| Australia 10-year bond* (%) | 4.06 | 4.09 | -0.03 |

| Australia 20-year bond* (%) | 4.46 | 4.49 | -0.03 |

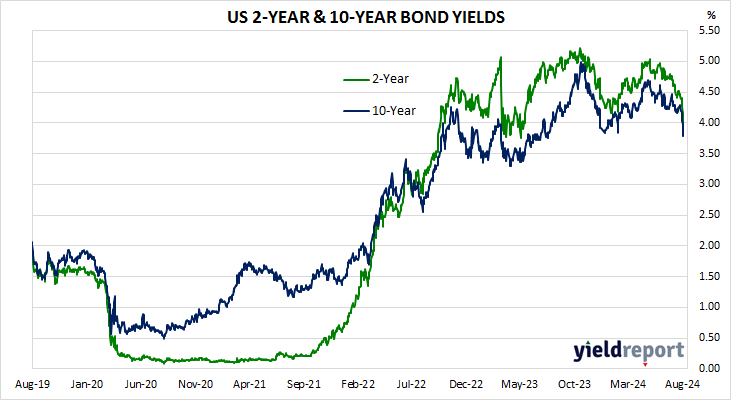

| United States 2-year bond (%) | 3.88 | 4.15 | -0.27 |

| United States 10-year bond (%) | 3.79 | 3.98 | -0.19 |

| United States 30-year bond (%) | 4.11 | 4.28 | -0.17 |

* Implied yields from September 2024 futures. As at 2 August.

LOCAL MARKETS

Australian Commonwealth Government bond yields fell, steepening the curve in the process. Data releases included June quarter PPIs and June housing finance approvals.

The next RBA Board meeting ends 6 August. August futures implied an average cash rate of 4.33% for the month, thus pricing in no real chance of any change at the meeting. July 2025 futures implied 3.745%, 60bps below the current cash rate, thus pricing in two 25bp cuts and some chance of a third between now and next July.

US MARKETS

US Treasury bond yields dived across the curve, with falls heaviest at the short end. Data releases were limited to July non-farm payrolls.

The next FOMC meeting ends on 18 September. September federal funds futures implied an average cash rate of 5.11% for the month and thus a 100% probability of at least a 25bp rate cut at the meeting. July 2025 contracts implied 3.28%, 205bps less than the current rate.