| Close | Previous Close | Change | |

|---|---|---|---|

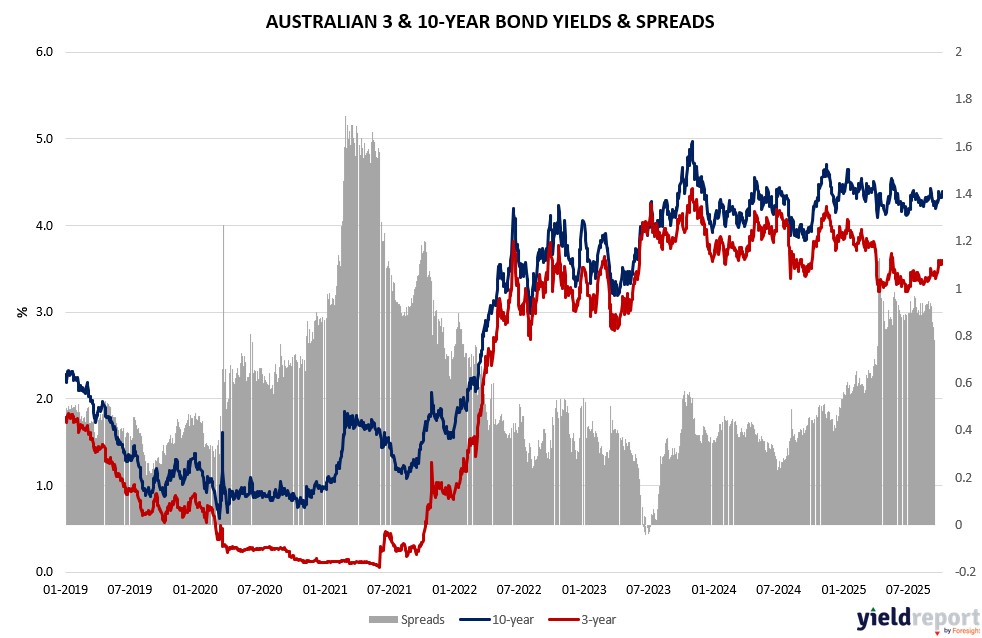

| Australian 3-year bond (%) | 3.592 | 3.556 | 0.036 |

| Australian 10-year bond (%) | 4.392 | 4.32 | 0.072 |

| Australian 30-year bond (%) | 5.012 | 5.015 | -0.003 |

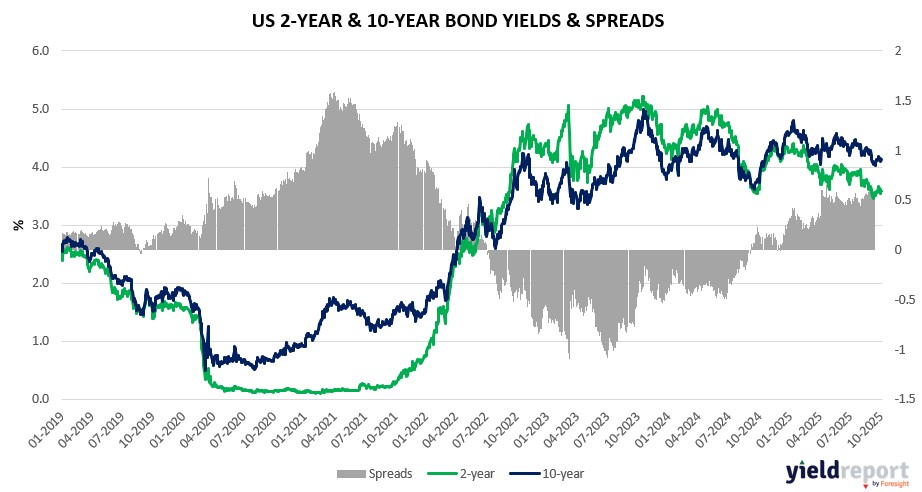

| United States 2-year bond (%) | 3.574 | 3.555 | 0.019 |

| United States 10-year bond (%) | 4.135 | 4.098 | 0.037 |

| United States 30-year bond (%) | 4.7398 | 4.7007 | 0.0391 |

Overview of the Australian Bond Market

Australian government bonds saw no trading on October 6, 2025 due to the Labour Day.

Overview of the US Bond Market

Treasuries sold off on October 6, 2025, with the 10-year yield rising 4 basis points to 4.16% as AI momentum and earnings optimism overshadowed shutdown data delays and fiscal worries. The 2-year advanced to 3.60%, 5-year to 3.73%, and 30-year to 4.76%. Shorter maturities held with 3-month at 3.85% and 6-month at 3.70%.

Challenger’s dialed-back September hiring amid fewer cuts signals cooling labor, with JPMorgan’s Kim Crawford noting cyclical weakness and wage stagnation supporting quarter-point cuts in October and December despite voids. Shutdown may delay trade, claims, orders, payrolls, unemployment, and earnings data, complicating Fed’s late-October decision, with Charles Schwab’s Joe Mazzola warning prolonged closure hurts growth per Treasury Secretary Scott Bessent. Barclays sees 82% S&P gain odds, but Deutsche Bank’s Parag Thatte notes overweight positioning with momentum pockets. Piper Sandler’s Craig Johnson suggests shallow pullback for better risk-reward.