Westpac and the Melbourne Institute describe their Leading Index as a composite measure which attempts to estimate the likely pace of economic activity relative to trend in Australia. The index combines certain economic variables which are thought to lead changes in economic growth into a single variable. This variable is claimed to be a reliable cyclical indicator for the Australian economy and an indicator of swings in Australia’s overall economic activity.

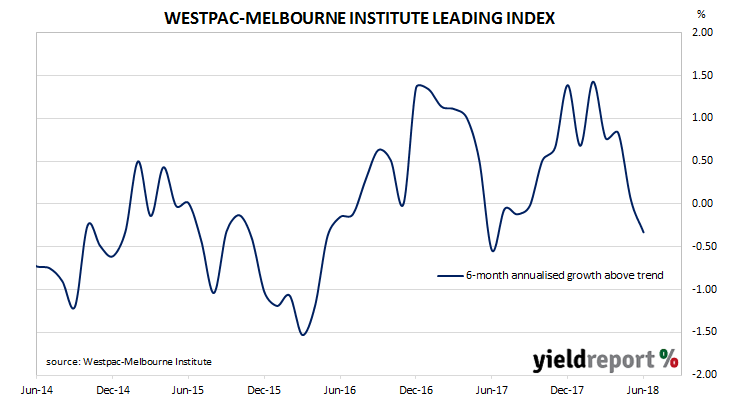

The six month annualised growth rate of the indicator fell from a revised +0.05% in May to -0.33% in June. These figures represent growth rates relative to trend-GDP growth, which is generally thought to be around 2.75% per annum for Australia. The Index is said to lead GDP by 3 months to 6 months, so theoretically the current reading represents an annualised GDP growth rate of around 2.5% in the September or December quarters.

According to Westpac chief economist Bill Evans, the largest negative influences included increased expectations of becoming unemployed and lower commodity prices when measured in Aussie dollars. Other components of the index either had less positive effects or outright negative effects when compared to May’s figures.