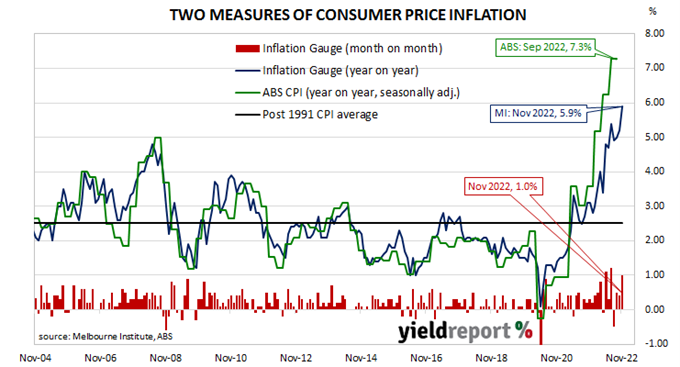

Summary: Melbourne Institute Inflation Gauge index up 1.0% in November; up 5.9% on annual basis.

The Melbourne Institute’s Inflation Gauge is an attempt to replicate the ABS consumer price index (CPI) on a monthly basis. It has turned out to be a reliable leading indicator of the CPI, although there are periods in which the Inflation Gauge and the CPI have diverged for as long as twelve months. On average, the Inflation Gauge’s annual rate tends to overestimate the ABS rate by around 0.1%.

The Melbourne Institute’s latest reading of its Inflation Gauge index indicates consumer prices increased by 1.0% in November. The rise follows increases of a 0.4% and 0.5% in October and September respectively. On an annual basis, the index rose by 5.9%, up from 5.2% in October.

Commonwealth Government bond yields moved lower on the day. By the close of business, the 3-year ACGB yield had slipped 1bp to 3.03%, the 10-year yield had lost 2bps to 3.37% while the 20-year yield finished 6bps lower at 3.71%.

In the cash futures market, expectations regarding future rate rises softened. At the end of the day, contracts implied the cash rate would rise from the current rate of 2.81% to average 2.96% in December and then increase to an average of 3.10% in February. May 2023 contracts implied a 3.345% average cash rate while August 2023 contracts implied 3.525%.

Central bankers desire a certain level of inflation which is “sufficiently low that it does not materially distort economic decisions in the community” but high enough so it does not constrain “a central bank’s ability to combat recessions.” Hence the recent obsession among central banks, including the RBA, to increase inflation.