Summary –

The Australian bank hybrid securities market continues to offer compelling income opportunities, with updated figures reflecting a stable and attractive yield environment.

- Average Trading Margin: 4.94%

- Average Running Yield: 8.54%

These averages suggest that hybrids remain a strong option for income-focused investors, offering consistent returns above benchmark rates.

Top Performers

- Highest Trading Margin: Nufarm (NFNG) at 5.24%

- Highest Running Yield: Nufarm (NFNG) at 8.84%

Bottom Performers

- Lowest Trading Margin: Ramsay Health Care (RHCPA) at 4.64%

- Lowest Running Yield: Ramsay Health Care (RHCPA) at 8.24%

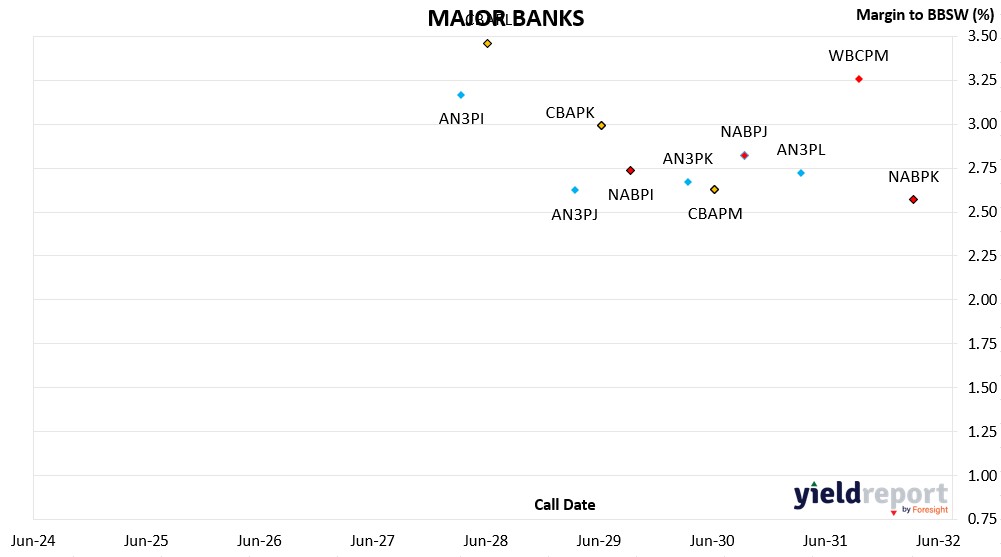

Major Banks

The “Major Banks” scatter plot shows a tight clustering of securities with call dates between 2026 and 2032, and margins to BBSW generally ranging from 2.5% to 3.5%. This reflects:

- A compressed spread environment, typical of high-credit-quality issuers.

- Longer-dated hybrids offering slightly lower margins, consistent with reduced reinvestment risk and investor preference for duration certainty.

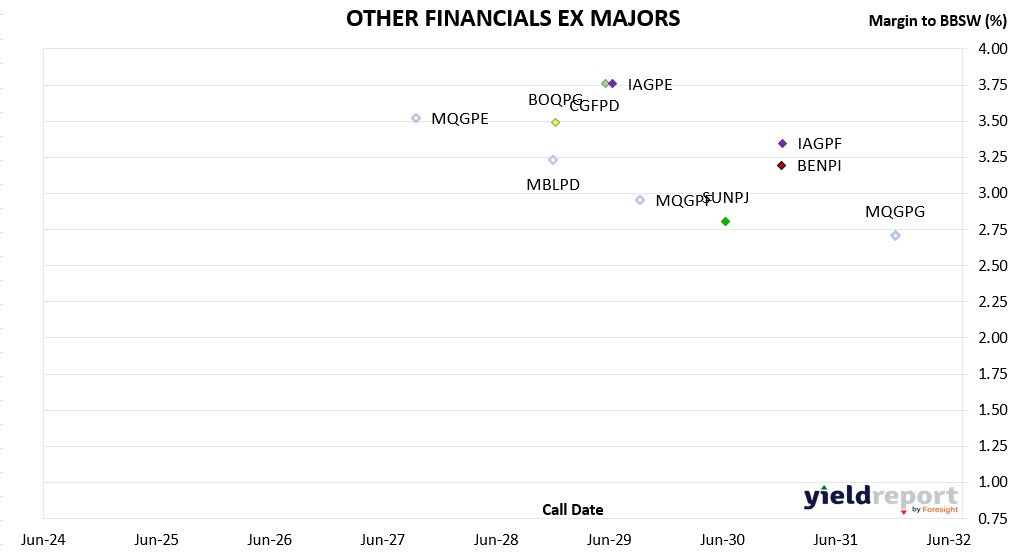

Other Financials (Ex Majors)

The “Other Financials Ex Majors” chart reveals a broader spread range, with margins to BBSW extending from 0.75% to 4.00%:

- Securities such as BOQPF, IAGPE, BENPI, and MQGPG show higher margins, indicating either higher perceived risk or greater yield incentives.

- The wider dispersion suggests greater diversity in credit profiles and investor appetite for yield among non-major issuers.

The charts reinforce a key theme: major banks offer tighter spreads with lower risk, while non-major financials provide higher margins for those willing to take on additional credit exposure. With most hybrids yielding above 6%, the market remains attractive for investors seeking reliable income streams.

-

COMPANY CODE HYBRID TYPE MATURITY/

CALL

DATEMARGIN

INCL. CREDITSTRADING

MARGINDAY

CHANGEDAY

CLOSERUNNING

YIELD**Challenger CGFPC Capital Notes 3 25-05-2026 4.60% 9.16% 0.06% 102.66 8.42% Nat Aust Bank NABPF Capital Notes 3 17-06-2026 4.00% 8.19% 0.05% 101.7 7.80% Suncorp SUNPH Capital Notes 3 17-06-2026 3.00% 7.84% 0.05% 100.72 6.81% Macquarie Group MQGPD Capital Notes 4 10-09-2026 4.15% 6.21% 0.03% 102.3 7.88% CBA CBAPJ PERLS 13 20-10-2026 2.75% 5.66% 0.03% 101 6.52% Latitude LFSPA Capital Notes 27-10-2026 4.75% 13.91% 0.06% 97.9 9.09% Westpac WBCPJ Capital Notes 7 22-03-2027 3.40% 6.27% 0.03% 102.5 7.26% CBA CBAPI PERLS 12 20-04-2027 3.00% 4.26% 0.02% 102.25 6.70% Bank of Queensland BOQPF Capital Notes 2 14-05-2027 3.80% 5.09% 0.02% 103.73 7.52% Bendigo Bank BENPH Capital Notes 15-06-2027 3.80% 4.63% 0.02% 103.27 7.47% Macquarie Group MQGPE Capital Notes 5 20-09-2027 2.90% 3.52% 0.01% 102.4 6.55% Nat Aust Bank NABPH Capital Notes 5 17-12-2027 3.50% 4.00% 0.01% 103.4 7.15% ANZ Bank AN3PI Capital Notes 6 20-03-2028 3.00% 3.17% 0.01% 102.79 6.60% CBA CBAPL PERLS 15 15-06-2028 2.85% 3.46% 0.01% 102.62 6.52% Suncorp SUNPI Capital Notes 4 17-06-2028 2.90% 3.28% 0.01% 103.19 6.54% Westpac WBCPL Capital Notes 9 22-09-2028 3.40% 4.07% 0.01% 104.75 7.09% Macquarie Bank MBLPD Capital Notes 3 07-12-2028 2.90% 3.23% 0.01% 102.8 6.53% Bank of Queensland BOQPG Capital Notes 3 15-12-2028 3.40% 3.49% 0.01% 104.2 6.99% Judo Capital JDOPA Capital Notes 16-02-2029 6.50% 4.79% 0.01% 112 9.61% ANZ Bank AN3PJ Capital Notes 7 20-03-2029 2.70% 2.62% 0.01% 103.3 6.26% Challenger CGFPD Capital Notes 4 25-05-2029 3.60% 3.76% 0.01% 104.63 7.20% CBA CBAPK PERLS 14 15-06-2029 2.75% 2.99% 0.01% 103.3 6.37% IAG IAGPE Capital Notes 2 15-06-2029 3.50% 3.76% 0.01% 104.8 7.12% Macquarie Group MQGPF Capital Notes 6 12-09-2029 3.70% 2.96% 0.01% 106.49 7.10% Nat Aust Bank NABPI Capital Notes 6 17-09-2029 3.15% 2.74% 0.01% 105.599 6.64% Westpac WBCPK Capital Notes 8 21-09-2029 2.90% 3.70% 0.01% 103.6 6.64% ANZ Bank AN3PK Capital Notes 8 20-03-2030 2.75% 2.67% 0.01% 103.453 6.31% CBA CBAPM PERLS 16 17-06-2030 3.00% 2.63% 0.01% 105.6 6.48% Suncorp SUNPJ Capital Notes 5 17-06-2030 2.80% 2.80% 0.01% 104.07 6.37% Nat Aust Bank NABPJ Capital Notes 7 17-09-2030 2.80% 2.82% 0.01% 104.05 6.38% Bendigo Bank BENPi Capital Notes 2 13-12-2030 3.20% 3.20% 0.01% 104.5 6.76% Insurance Australia IAGPF Capital Notes 3 15-12-2030 3.20% 3.35% 0.01% 104.66 6.80% ANZ Bank AN3PL Capital Notes 9 20-03-2031 2.90% 2.72% 0.00% 104.028 6.42% Westpac WBCPM Capital Notes 10 22-09-2031 3.10% 3.26% 0.01% 105.65 6.71% Macquarie Group MQGPG Capital Notes 7 15-12-2031 2.65% 2.71% 0.01% 103.4 6.24% Nat Aust Bank NABPK Capital Notes 8 17-03-2032 2.60% 2.57% 0.01% 104.2 6.16% -

COMPANY CODE BOND TYPE CALL DATE ISSUE MARGIN (inc frank) TRADING MARGIN ?DAY CLOSING PRICE RUNNING YIELD Nufarm NFNG Step Up Perpetual 3.90% 5.24% 0.07% 90.5 8.84% Ramsay Health Care RHCPA Preference Share Perpetual 4.85% 4.64% 0.05% 108.639 8.24%