| Close | Previous Close | Change | |

|---|---|---|---|

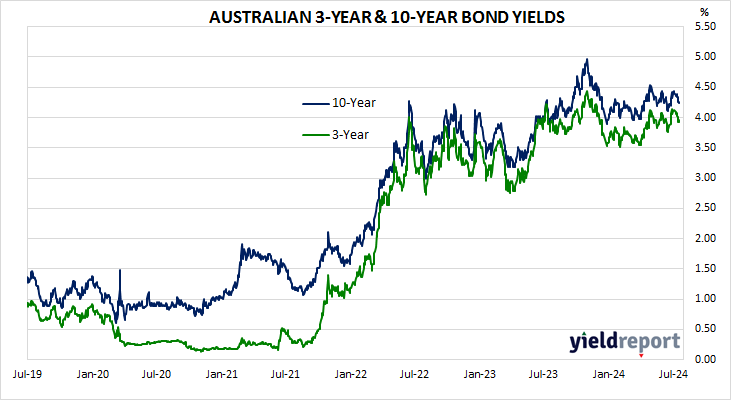

| Australia 3-year bond* (%) | 3.95 | 3.93 | 0.02 |

| Australia 10-year bond* (%) | 4.25 | 4.26 | -0.01 |

| Australia 20-year bond* (%) | 4.59 | 4.60 | -0.01 |

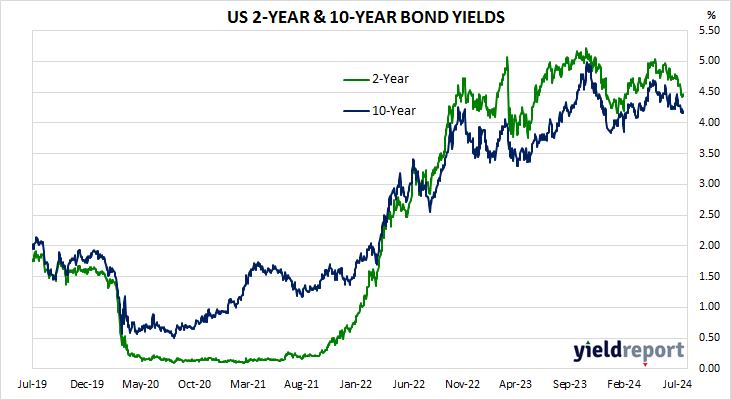

| United States 2-year bond (%) | 4.47 | 4.44 | 0.03 |

| United States 10-year bond (%) | 4.20 | 4.16 | 0.04 |

| United States 30-year bond (%) | 4.42 | 4.38 | 0.04 |

* Implied yields from September 2024 futures. As at 18 July.

LOCAL MARKETS

Short-term Australian Commonwealth Government bond yields finished modestly higher while longer-term yields slipped a touch, unlike the generally modest rises of US Treasury yields on Wednesday night (AEST). Data releases were limited to June Labour Force figures.

The next RBA Board meeting ends 6 August. August futures imply an average cash rate of 4.385% for the month, thus pricing some chance of a 25bp rate rise at the meeting. July 2025 futures imply 4.065%, 27bps below the current cash rate, thus pricing in one 25bp cut (in net terms) between now and next July.

US MARKETS

US Treasury bond yields increased by moderate amounts along the curve. Data releases included the June reading of the Conference Board Leading Index, the Philadelphia Fed’s July Activity Index and weekly initial jobless claims.

The next FOMC meeting ends on 31 July. August federal funds futures implied an average cash rate of 5.315% for the month and thus a tiny chance of a 25bp rate cut at the meeting. However, July 2025 contracts implied 3.995%, 133bps less than the current rate.