Commentary courtesy of Spectrum Asset Management’s Lindsay Skardoon.

| Close | Prev Close |

Change | |

| Aust. 90 day bank bill% | 1.97 | 1.97 | 0.00 |

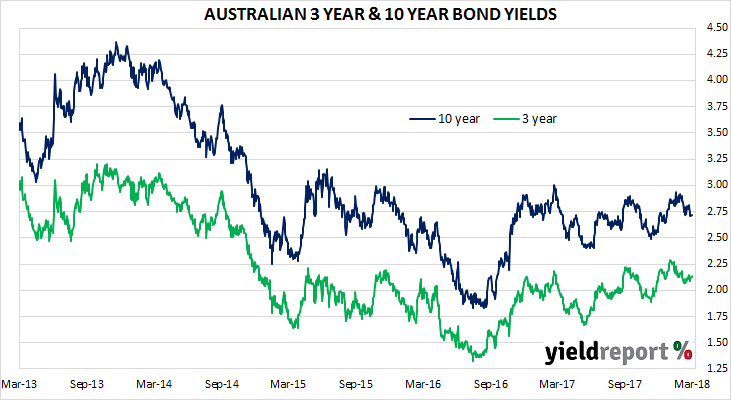

| Aust. 3 year bond%* | 2.14 | 2.13 | 0.01 |

| Aust. 10 year bond%* | 2.72 | 2.72 | 0.00 |

| Aust. 20 year bond%* | 3.10 | 3.11 | -0.01 |

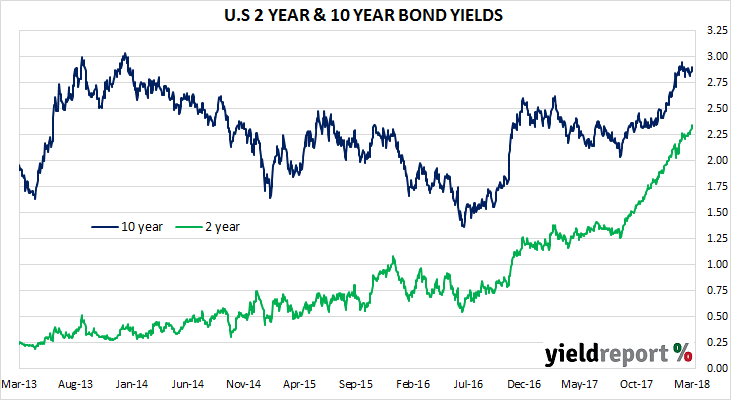

| U.S. 2 year bond% | 2.34 | 2.32 | 0.02 |

| U.S. 10 year bond% | 2.90 | 2.86 | 0.04 |

| U.S. 30 year bond% | 3.13 | 3.09 | 0.04 |

| * Implied yields from June 2018 futures | |||

LOCAL MARKETS

Bonds should weaken on the day. With the Fed likely to deliver a rate hike tomorrow, traders will be more likely to be on the short side. However dovish commentary could cause U.S. bonds to rally before fiscal concerns arise leading to a selloff. A rally could be used to reset shorts.

U.S. BOND MARKETS

The bond market saw the 2-year treasury note hit a nine-year high. It is expected that the Fed will hike rates at least 3 times this year. There is a suggestion though that Powell may be more dovish than his predecessor and only hike three times thus allowing Trump’s stimulatory tax policy to work. The U.S. will need significant economic growth otherwise its fiscal deficit will grow alarmingly. The bond market is looking for a hawkish meeting.