Summary: BBSW generally steady; swap rates increase; swap spreads tighten modestly.

Bank bill swap rates generally remained pretty steady this week.

| TERM TO MATURITY | CLOSING RATE | Δ WEEK | Δ MONTH |

|---|---|---|---|

| 1 month | 4.31 | 0.00 | 0.01 |

| 3 months | 4.42 | 0.00 | 0.05 |

| 6 months | 4.62 | 0.04 | 0.11 |

Swap rates increased across the curve but lagged the rises of their Commonwealth Government counterparts.

| TERM TO MATURITY | CLOSING RATE | Δ WEEK | Δ MONTH | ||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| 1 year | 3.98 | 0.06 | -0.06 | ||||||||||

| 3 years | 3.49 | 0.06 | -0.12 | ||||||||||

| 5 years | 3.70 | 0.08 | -0.09 | ||||||||||

| 10 years | 3.98 | 0.08 | -0.07 | ||||||||||

| 15 years | 4.14 | 0.08 | -0.06 |

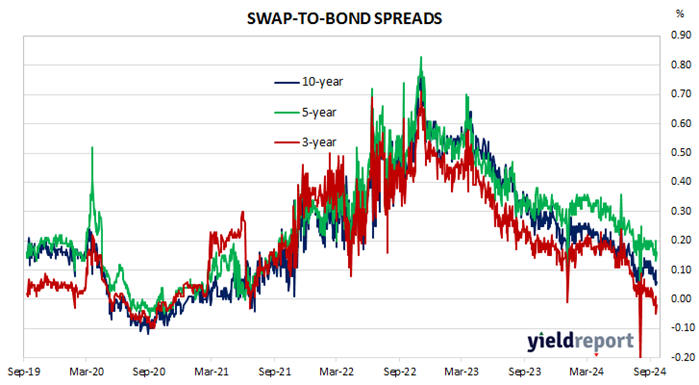

As a result, swap spreads tightened modestly. By the end of the week, the 3-year spread had lost 2bps to -2bps, the 5-year yield had slipped 1bp to 16bps while the 10-year spread finished 2bps lower at 6bps.

NB. Spreads are calculated with respect to “spot” Australian Commonwealth Government bond yields.