Summary:

Australia’s latest wage data underscored persistent labour-market tightness and ongoing productivity weakness, posing fresh challenges for the Reserve Bank of Australia (RBA) as it attempts to steer inflation back toward target. The Wage Price Index rose 3.4% year-on-year and 0.8% quarter-on-quarter, in line with expectations, but continued to highlight mismatches between labour demand and supply. Public-sector wage growth once again outpaced the private sector, driven largely by state-government pay agreements. Health care and social assistance made the strongest contribution to quarterly increases, while financial services, media and recreation sectors lagged.

Economists warn that sustained wage strength suggests employers are still struggling to recruit suitably skilled workers, reinforcing upward wage pressure despite weak productivity. This combination risks keeping real unit labour costs elevated, a key concern for the RBA as it monitors firms’ price-setting behaviour. Governor Michele Bullock has signalled that further policy easing is unlikely in the near term, particularly given still-firm wages, resilient consumer spending and unemployment holding near historic lows. Markets now see only a slim chance of another rate cut in 2026, with most economists expecting easing to resume around May.

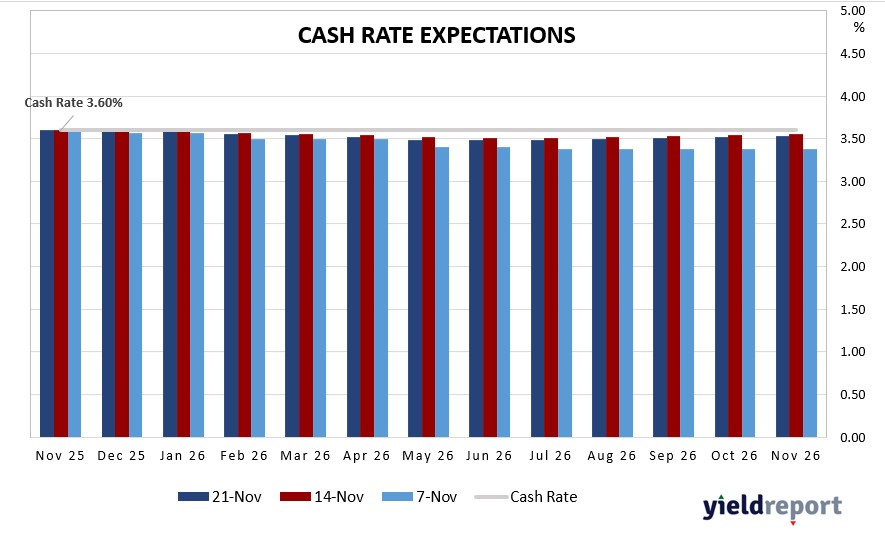

Figure 1: Market Expectation on Cash Rate

-

Product Interest

Rate p.a.Notes AMP Saver Account 4.45% To earn the bonus rate, you must grow your account balance by at least $250 (excluding interest earned) by the end of each calendar month. Applies to balances up to $500,000. ANZ Premium 0.05% $10,000 - $249,999 ANZ Progress Saver 3.05% To earn the bonus rate, you must deposit at least $10 in one transaction and not make any withdrawals or transfers during the month.Applies to balances up to $500,000 Arab Bank Online Savings 4.35% No minimum deposit or monthly conditions to earn interest.Applies to balances up to $499,999 for the higher rate Bankwest Hero Saver 4.00% Variable Hero rate on eligible balances up to $250,000.99. CBA NetBank Saver 4.45% 4.45% p.a. for the first 5 months (includes a 2.90% p.a. fixed bonus margin above the standard variable rate of 1.55% p.a. CBA Goal Saver Account 4.25% 4.25% p.a. when you grow your balance each calendar month (excluding interest and transactions initiated by the bank) Heritage Online Saver 4.00% get a 4 month Bonus Intro Rate* available for new members on balances up to $100,000. ING Savings Accelerator 5.00% To earn the bonus rate, you must deposit at least $1,000 into a personal ING account, make 5 eligible transactions with a linked Orange Everyday account, and grow the balance each month Macquarie CMA 2.00% Interest rates vary based on account balance tiers.applies $10,000,000 and above: ME Online Savings 3.60% Bonus interest applies to balances up to $250,000. NAB iSaver 4.45% for the first 4 months (includes a 3.15% p.a. fixed bonus margin above the standard variable rate of 1.25% p.a.Available to new customers or those who haven't held a NAB iSaver in the last 12 months. NAB Reward Saver 4.15% includes a 0.10% p.a. variable base rate and a 4.00% p.a. variable bonus rate).To earn the bonus rate, you must make at least one deposit on or before the second last banking day and no withdrawals. Rabobank PremiumSaver 4.65% On balances to $250,000. Balance increased by $200 a month. RAMS Saver Account 1.40% On balances to $500,000. Minimum $200 deposit each month with no withdrawals. Suncorp Growth Saver 4.30% Earn 4.30% p.a. Growth Saver bonus interest each month you grow your net balance by $200 or more (excluding interest) and make no more than one withdrawal. ubank Save Account 5.10% All you need to do is have a Spend account and deposit $500+ per month into any Spend, Bills, or Save accounts (not including internal transfers) to get the bonus interest rate. Easy. Up Savers Account 4.30% To earn the bonus rate, you must deposit at least $200 each month and make no withdrawals. Westpac eSaver 4.25% Fixed rate for the first 5 months for new eSaver customers.