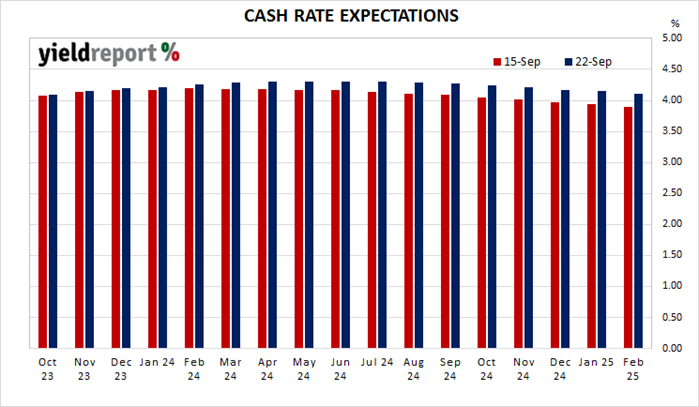

Summary: Cash rate expectations for 2023, 2024 higher; cash rate now expected to average 4.295% in August 2024; 3-month BBSW up 2bps; no changes to surveyed ADI cash rates.

Expectations moved this week in a manner which suggested the path of the cash rate will be higher over the next eighteen months in comparison with its expected path at the end of the previous week. Contracts at the end of the week implied the cash rate would rise a touch from the current rate of 4.07% to average 4.085% through October, move up to 4.145% in November and then average 4.195% in December. February 2024 contracts implied a cash rate of 4.265%, 20bps above the current cash rate, while August 2024 contracts implied 4.295%, up from 4.105% a week ago.

Since March 2020, the RBA has not enforced its cash rate target by draining liquidity from the banking system. As a result, the actual cash rate has been noticeably below the target rate. As such, contract prices only reflect expectations of the average actual cash rate in a given month and not the implied likelihood of the RBA changing its target.

The minutes of the RBA Board’s August meeting were released on Tuesday. As with the previous meeting, there was nothing really new in them but overnight cash markets reacted in a hawkish manner.

Westpac and the Melbourne Institute released the August reading of their leading index the next day. The annualised growth rate increased from July’s upwardly-revised figure but remained well in negative (below trend) territory.

The latest flash Judo Bank Composite PMI came out at the end of the week. The composite index rose from August’s final reading of 48.0 to 50.2, the manufacturing index fell from 49.2 to 48.2 while the services index rose from 47.8 to 50.5.

3-month BBSW is a useful benchmark for cash rates and it finished the week 2bps higher at 4.15%. The RBA’s target for the overnight lending rate between banks is 4.10% but actual overnight interbank loans are being negotiated at 4.07%, 3bps below the target but 7bps above the RBA’s exchange settlement account (ESA) rate for ADI deposits with it.

There were no changes made by deposit-taking institutions in our survey of cash account interest rates this week.

CASH ACCOUNTS

| Product | Interest Rate p.a. | Notes |

|---|---|---|

| AMP Saver Account | 5.00% | Min. monthly $1,000 dep. Limit $250,000. |

| ANZ Premium | 0.05% | $10,000 - $499,999 |

| ANZ Progress Saver | 4.25% | Make at least one deposit of $10 or more in a month, make no withdrawals (including transfers), or incur any fees, charges in the month. |

| Arab Bank Online Savings | 1.00% | On balances of $250,000 to $499,999 |

| Bankwest Smart eSaver | 2.20% | On balances up to $500,000.99 with no withdrawals in that month |

| BOQ Fast Track Saver | 2.75% | $1000 minimum monthly deposit. On balances up to $250,000, over part the Base Rate of 0.05% p.a. applies |

| BoQ Bonus Interest Savings | 2.75% | Bonus interest is paid into your account when you limit your withdrawals to a maximum of one per month |

| CBA NetBank Saver | 2.20% | 2.40% p.a. fixed bonus margin for the first 5 months on your first NetBank Saver |

| CBA Goal Saver Account | 4.65% | At least 1 deposit required; balance at end of month must exceed balance at start of month. |

| Great Southern Bank | 4.20% | No bonus conditions |

| Heritage Online Saver | 3.40% | $1 or more, bonus intro rate 1.45% (promotional 4 month rate on new accounts up to $100,000) |

| ING Savings Accelerator | 4.35% | $150,000 and over |

| Macquarie CMA | 2.75% | Minimum $5,000 |

| ME Online Savings | 4.25% | Have both Online Savings Account and Everyday Transaction Account. On balances up to $250,000. Make at least four "tap & go" purchases per month. |

| NAB iSaver | 2.00% | Bonus rate 2.65% for the first four months when you open your first NAB iSaver account |

| NAB Reward Saver | 4.75% | make at least one deposit on or before the second last banking day of the month and no withdrawals during the month |

| Rabobank PremiumSaver | 4.85% | On balances to $250,000. Balance increased by $200 a month. |

| RAMS Saver Account | 1.40% | On balances to $500,000. Minimum $200 deposit each month with no withdrawals. |

| Suncorp Growth Saver | 4.85% | Minimum $200 deposit each month and no more than 1 withdrawal |

| ubank Save Account | 5.00% | On a combined balance of up to $250,000. Minimum $200 deposit each month into Spend or Save accounts. |

| Up Savers Account | 4.35% | Make 5 successful purchases using your Up or 2Up debit card or digital wallets in a month. |

| Westpac eSaver | 1.10% | 4.25% p.a. for the first 5 months for new Westpac eSaver customers |

| Westpac Reward Saver | 4.75% | Make a deposit to the account and ensure account balance is higher at the end of the month than the beginning. Keep your account balance above $0 at all times. |