| Close | Previous Close | Change | |

|---|---|---|---|

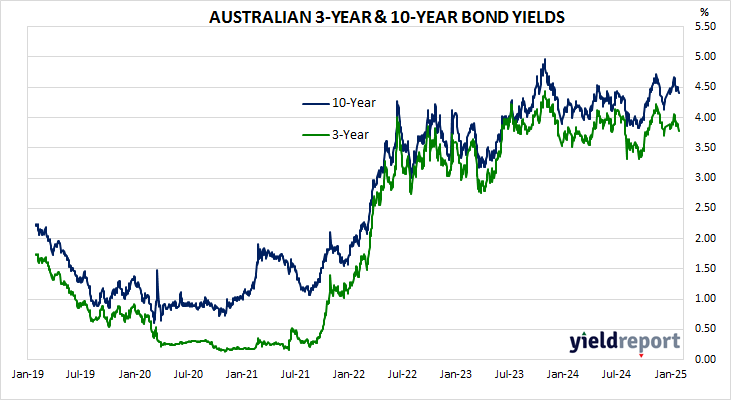

| Australian 3-year bond (%) | 3.741 | 3.795 | -0.05 |

| Australian 10-year bond (%) | 4.301 | 4.346 | -0.04 |

| Australian 30-year bond (%) | 4.849 | 4.875 | -0.03 |

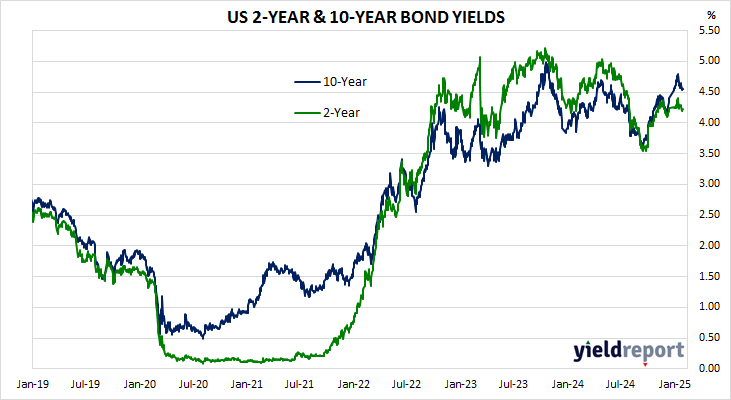

| United States 2-year bond (%) | 4.028 | 4.053 | -0.03 |

| United States 10-year bond (%) | 4.227 | 4.266 | -0.04 |

| United States 30-year bond (%) | 4.508 | 4.538 | -0.03 |

* Implied yields from March 2025 futures. As at 29 January.

LOCAL MARKETS

Australia’s 10-year government bond yield fell to around 4.35%, hovering near its lowest level in three weeks. Domestic yields mirrored a decline in US bond yields as investors await the PCE index report for cues into the Federal Reserve’s monetary policy trajectory. In Australia, a report

released on Thursday showed that business investment unexpectedly declined in the fourth quarter, indicating a slight drag on economic growth and adding to case for more policy easing.

Meanwhile, data on Wednesday showed headline inflation held at an annual 2.5% in January, while core inflation ticked up to 2.8%. While this report does not provide definitive signal for further rate cuts, it offers reassurance that inflation is trending in the right direction and supports the Reserve Bank of Australia’s recent rate cut. However, RBA Deputy Governor Andrew Hauser said on Thursday that the central bank would need to see further progress in inflation before considering additional rate cuts.

US MARKETS

The yield on the 10-year US Treasury note was at the 4.25% mark on Friday, plunging over 15bps in the week to its lowest in over two months as markets assessed the latest economic data against concerns that tariffs and aggressive government spending cuts will hurt growth.

Personal spending in the US unexpectedly slipped in January while income soared. Additionally, headline and core PCE price indices edged higher as expected, maintaining market bets that the Federal Reserve is due to cut rates twice this year.

Meanwhile, President Trump announced 25% tariffs on European goods and confirmed similar measures on Mexico and Canada that were previously delayed, stoking fears of lower economic activity. The President also reiterated the goal to balance the US budget in his term despite current deficits ranging around the 7% to GDP mark, raising expectations of steep cuts to public expenditure and triggering sharp declines in Treasury yields.