| Close | Previous Close | Change | |

|---|---|---|---|

| Australian 3-year bond (%) | 3.956 | 3.934 | 0.022 |

| Australian 10-year bond (%) | 4.543 | 4.529 | 0.014 |

| Australian 30-year bond (%) | 5.046 | 5.026 | 0.020 |

| United States 2-year bond (%) | 4.270 | 4.274 | -0.004 |

| United States 10-year bond (%) | 4.507 | 4.535 | -0.028 |

| United States 30-year bond (%) | 4.7477 | 4.764 | -0.016 |

LOCAL MARKETS

Australia’s 10-year government bond yield hovered around 4.58%, remaining near its highest level in over a month, as investors digested strong labour market data. Employment climbed by 44,000 over the month in January, more than double market expectations of a 20,000 rise. The unemployment rate also ticked up to 4.1% from 4% in December, in line with forecasts. These figures indicate that the job market remains very tight, complicating the case for more rate cuts.

As we all know, earlier this week, the RBA lowered its cash rate by 25bps to 4.10%, marking the first reduction in more than four years. But the narrative from the RBA left many commentators in the market scratching their collective heads, with Michelle Bullock cautioning that further easing was not guaranteed given upside risks to inflation. If you are going to market a change in interest rate policy direction, should it not be done with conviction.?? And we go back to the opening sentence above – the 10-year is at its highest level in a month.

Market pricing currently implies only a 10% probability of another rate cut in April and suggests just 40bps of easing for 2025, equivalent to fewer than two rate cuts.

On the corporate bond side, both IG and HY, spreads across the developed market landscape – e.g. US, Europe, Australia, credit spreads are at record lows and credit is undoubtedly expensive across the quality spectrum. Issue is – what is going to lead to a widening in spreads?? But investors should be mindful of the event risk implicit here. One part of the market they does appear relatively attractive on a valuation basis is subordinated bank debt, a sector easily investible in Australia as well.

US MARKETS

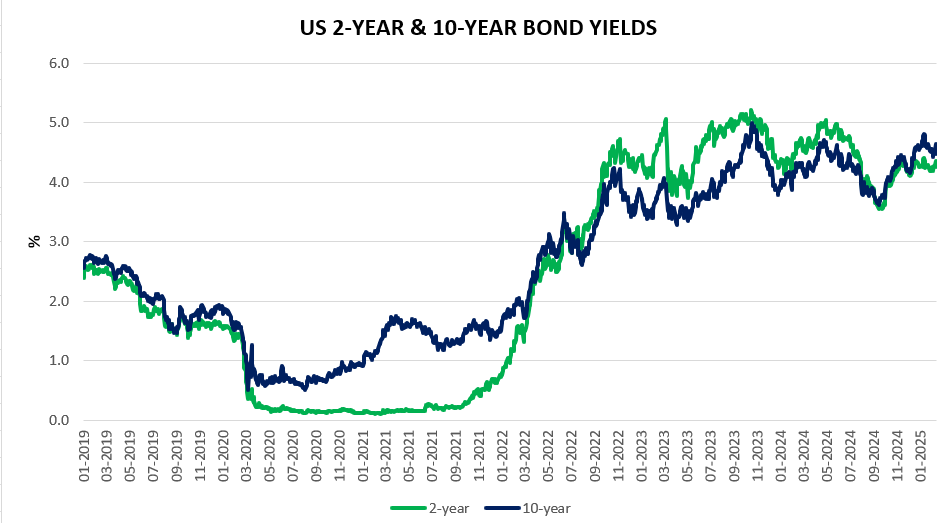

The yield on the 10-year US Treasury note was near the 4.5% threshold on Thursday, extending the slight pullback from the previous session as markets assessed the level of Treasury issuance of notes and bonds and potential buying from the Federal Reserve.

US Treasury Secretary Bessent noted that the Treasury will not increase the share of longer term securities in the near future, contradicting his earlier critiques of the old administration and limiting the supply of securities in the longer end of the curve. This compounded support for 10-year notes after FOMC minutes showed that the Fed thinks it may be appropriate to pause asset selling until the resolution of debt ceiling dynamics, setting the stage for a potential end to quantitative tightening.

In the meantime, jobless claim counts continued to point to a relatively strong labour market, adding leeway for the Federal Reserve to extend the pause of its cutting cycle.

On the corporate bond side, both IG and HY, spreads across the developed market landscape – e.g. US, Europe, Australia, credit spreads are at record lows and credit is undoubtedly expensive across the quality spectrum. Issue is – what is going to lead to a widening in spreads?? But investors should be mindful of the event risk implicit here. One part of the market they does appear relatively attractive on a valuation basis is subordinated bank debt, a sector easily investible in Australia as well.