| Close | Previous Close | Change | |

|---|---|---|---|

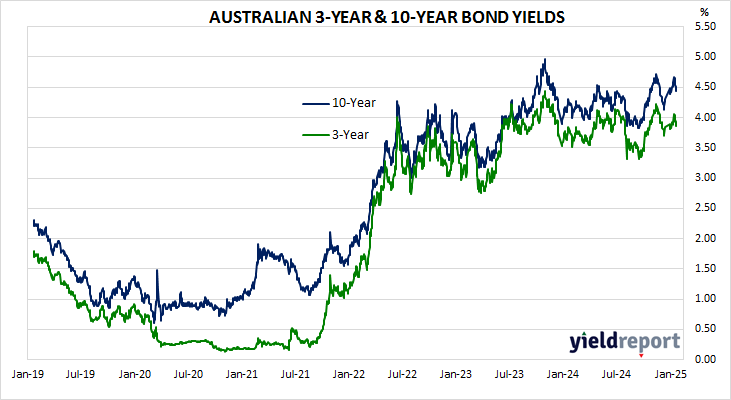

| Australia 3-year bond* (%) | 3.86 | 3.92 | -0.06 |

| Australia 10-year bond* (%) | 4.44 | 4.51 | -0.07 |

| Australia 20-year bond* (%) | 4.87 | 4.94 | -0.07 |

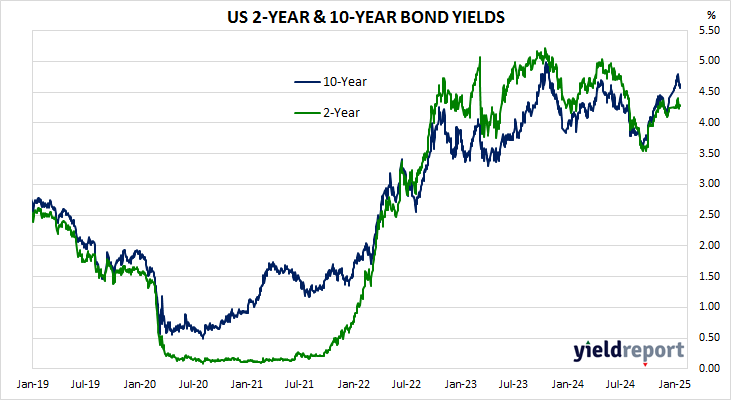

| United States 2-year bond (%) | 4.27 | 4.29 | -0.02 |

| United States 10-year bond (%) | 4.56 | 4.63 | -0.07 |

| United States 30-year bond (%) | 4.79 | 4.86 | -0.07 |

* Implied yields from March 2025 futures. As at 21 January.

LOCAL MARKETS

Australian Commonwealth Government bond yields fell significantly across the curve. There were no economic reports of note released on the day.

The next RBA Board meeting ends on 18 February 2025. February futures implied an average cash rate of 4.27% for the month, thus pricing in a good chance of a 25bp cut at the meeting. December futures implied 3.61%, 73bps below the current cash rate, thus inferring two 25bp cuts and a high probability of a third one between now and next December.

US MARKETS

US Treasury bond yields fell across a steeper curve. There were no notable economic reports released on the day.

The next FOMC meeting ends on 29 January. February federal funds futures implied an average cash rate of 4.325% for the month and thus a tiny probability of a 25bp rate cut at the meeting. December contracts implied 3.95%, 38bps less than the current federal funds effective rate.