| Close | Previous Close | Change | |

|---|---|---|---|

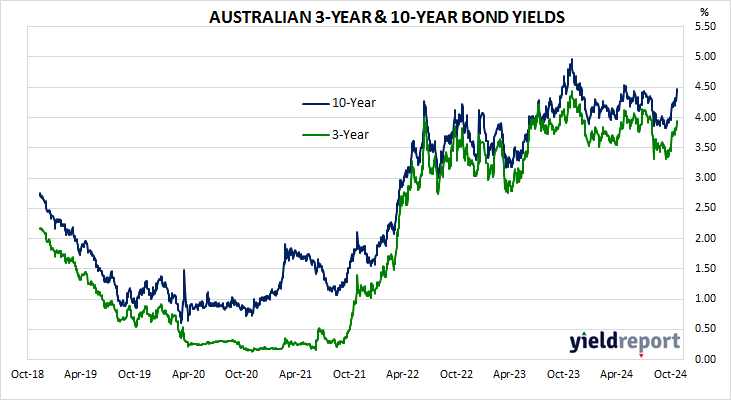

| Australia 3-year bond* (%) | 3.89 | 3.92 | -0.03 |

| Australia 10-year bond* (%) | 4.42 | 4.46 | -0.04 |

| Australia 20-year bond* (%) | 4.77 | 4.82 | -0.05 |

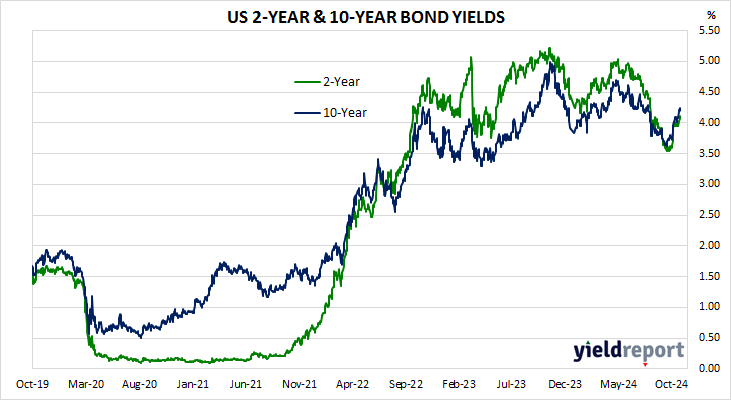

| United States 2-year bond (%) | 4.11 | 4.08 | 0.03 |

| United States 10-year bond (%) | 4.24 | 4.21 | 0.03 |

| United States 30-year bond (%) | 4.50 | 4.48 | 0.02 |

* Implied yields from December 2024 futures. As at 25 October.

LOCAL MARKETS

Australian Commonwealth Government bond yields declined across a flatter curve, in a somewhat-similar fashion to the moderate falls of US Treasury yields on Thursday night. The only domestic economic data of note was the 2023/24 Australian National Accounts.

The next RBA Board meeting ends on 5 November. November futures implied an average cash rate of 4.32% for the month, thus pricing in a low probability of a 25bp cut at the meeting. September 2025 futures implied 3.835%, 50bps below the current cash rate, thus inferring two 25bp cuts between now and next September.

US MARKETS

US Treasury bond yields rose moderately and almost uniformly across the curve. Economic data of note was limited to September durable goods numbers.

The next FOMC meeting ends on 7 November. November federal funds futures implied an average cash rate of 4.645% for the month and thus a high probability of a 25bp rate cut at the meeting. September 2025 contracts implied 3.66%, 117bps less than the current federal funds effective rate.