| Close | Previous Close | Change | |

|---|---|---|---|

| Australia 3-year bond* (%) | 3.78 | 3.72 | 0.06 |

| Australia 10-year bond* (%) | 4.26 | 4.21 | 0.05 |

| Australia 20-year bond* (%) | 4.65 | 4.60 | 0.05 |

| United States 2-year bond (%) | 3.98 | 3.94 | 0.04 |

| United States 10-year bond (%) | 4.10 | 4.02 | 0.08 |

| United States 30-year bond (%) | 4.36 | 4.30 | 0.06 |

* Implied yields from December 2024 futures. As at 17 October.

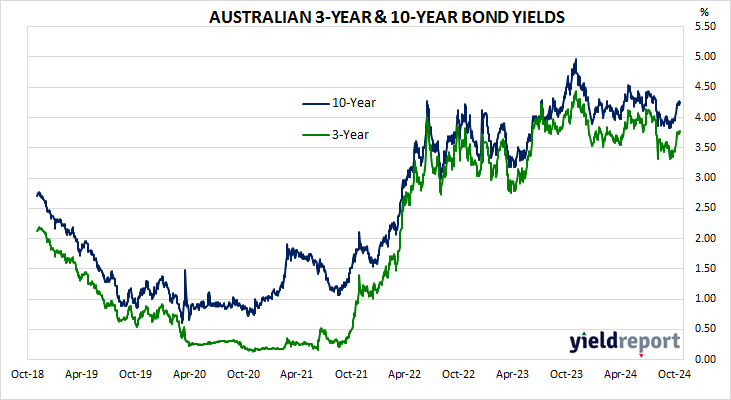

LOCAL MARKETS

Australian Commonwealth Government bond yields rose moderately across a slightly flatter curve. Domestic economic data on the day were limited to September Labour Force figures.

The next RBA Board meeting ends on 5 November. November futures implied an average cash rate of 4.31% for the month, thus pricing in a modest chance of a 25bp cut at the meeting. September 2025 futures implied 3.67%, 67bps below the current cash rate, or two 25bp cuts and a good chance of third one between now and next September.

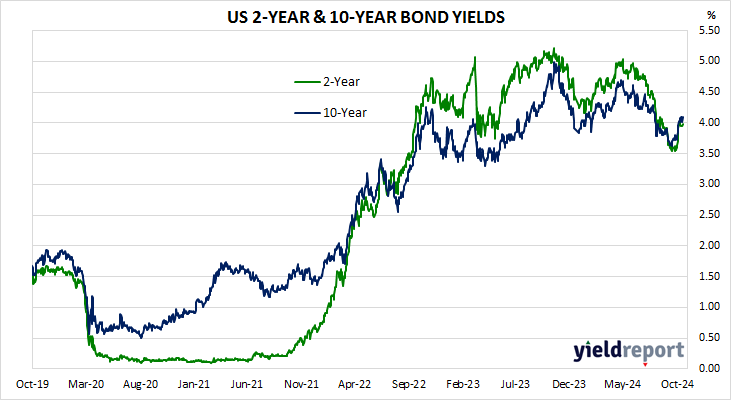

US MARKETS

US Treasury bond yields rose across a steeper curve. Economic data of note included reports for August business inventories, September retail sales, September industrial production, NAHB’s October Housing Market Index and weekly initial jobless claim figures.

The next FOMC meeting ends on 7 November. November federal funds futures implied an average cash rate of 4.655% for the month and thus a high probability of a 25bp rate cut at the meeting. September 2025 contracts implied 3.515%, 131bps less than the current federal funds effective rate.