| Close | Previous Close | Change | |

|---|---|---|---|

| Australian 3-year bond (%) | 3.447 | 3.446 | 0.001 |

| Australian 10-year bond (%) | 4.345 | 4.366 | -0.021 |

| Australian 30-year bond (%) | 5.093 | 5.098 | -0.005 |

| United States 2-year bond (%) | 3.561 | 3.606 | -0.045 |

| United States 10-year bond (%) | 4.134 | 4.203 | -0.069 |

| United States 30-year bond (%) | 4.8392 | 4.8856 | -0.0464 |

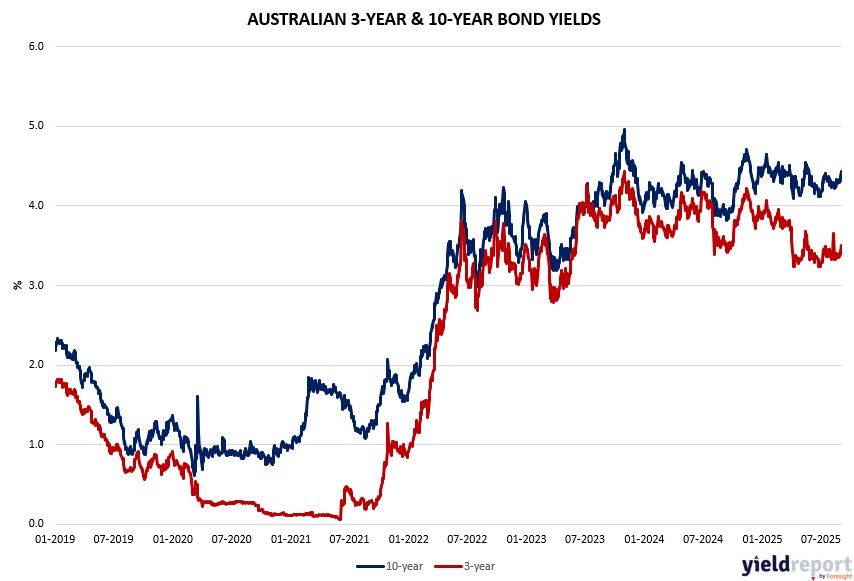

Overview of the Australian Bond Market

Australian government bonds rallied on September 5, 2025, with yields falling across the curve as softer US jobs data boosted global rate-cut bets and local economic indicators showed resilience. The 10-year yield dropped 2 basis points to 4.34%, the 5-year eased 1 basis point to 3.71%, and the 2-year held steady at 3.40%. The moves reflect investor positioning ahead of potential Reserve Bank easing, with recent data including a July trade surplus of 7.31 billion AUD, beating expectations and Q2 GDP at 0.6% quarter-on-quarter, supporting a soft landing narrative.

Bond traders are bracing for further volatility from US developments, where Fed rate cuts could widen yield differentials and pressure the Aussie dollar. Geopolitical tensions and Trump’s tariff threats have driven safe-haven flows into gold, indirectly supporting bonds, though fiscal concerns linger with surging debt. Dealers expect steady auction sizes in the coming quarter, aligning with April guidance.

In the broader context, Australia’s bonds have underperformed peers this year, with 10-year yields up 46 basis points annually, but the recent dip underscores market optimism for policy normalisation. Economists note stable labor demand from prior reports, though global slowdown risks could prompt earlier RBA action.

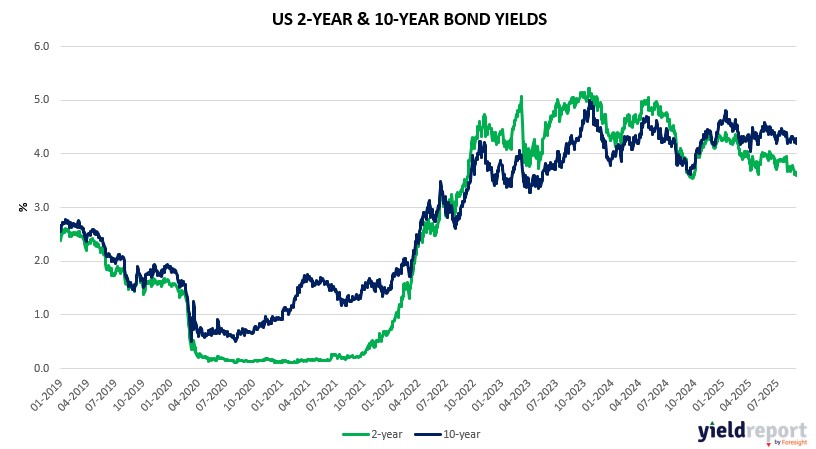

Overview of the US Bond Market

Bond traders ramped up bets on Treasuries following the weak August jobs report, pushing yields lower as markets price in aggressive Federal Reserve easing to counter slowdown signals. The 10-year yield fell to 4.07%, down from 4.10% weekly, while the 2-year dropped to 3.51% and the 30-year eased to 4.76%. The rally gained traction amid data showing non-farm payrolls at 22,000 versus 75,000 expected, unemployment at 4.3%, and average earnings up 3.7% year-on-year as forecast.

With the economy resilient despite trade wars, but showing cracks, the Fed faces pressure from Trump to cut rates, potentially facing dissent at the upcoming meeting. US Treasuries outperformed globally this year, with 10-year yields down 15 basis points monthly, contrasting with rises elsewhere, as bond vigilantes stay sidelined by growth data and policy expectations.

JPMorgan’s client survey showed net long positions shrinking to two-month lows, with asset managers paring longs by $23.5 million per basis point, focused on 5-year and 30-year contracts. Leveraged funds reduced shorts in the bond contract. Dealers uniformly anticipate unchanged coupon auction sizes for August-October.

Trade deals with the EU and Japan have eased some uncertainty, bolstering the case for higher-for-longer rates, but the jobs miss opens the door for September action. West Texas Intermediate crude fell 3.09% to $62.03, adding deflationary pressure, while gold’s 3.88% rise supports haven demand amid fiscal and independence concerns.