| Close | Previous Close | Change | |

|---|---|---|---|

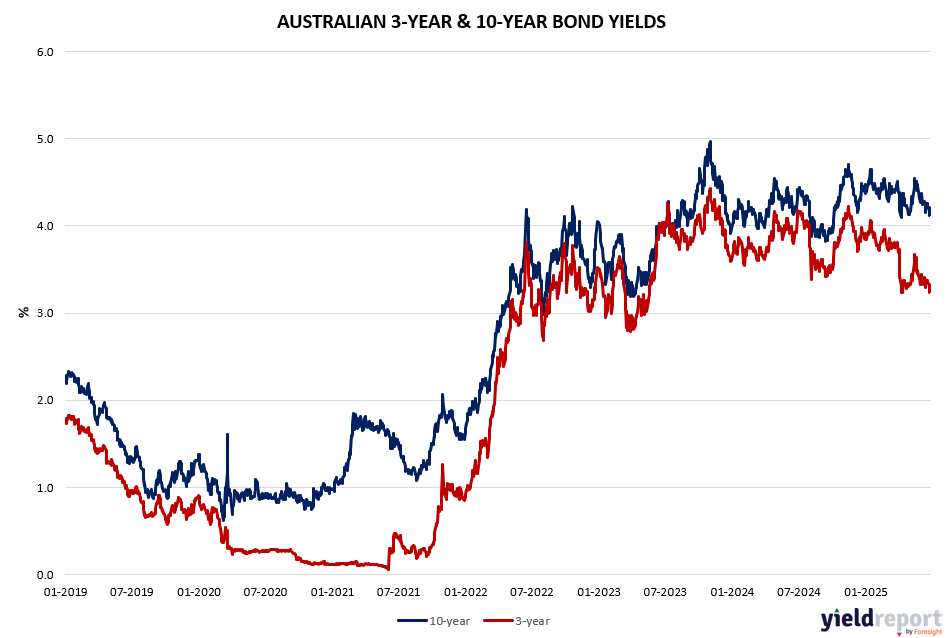

| Australian 3-year bond (%) | 3.237 | 3.237 | 0 |

| Australian 10-year bond (%) | 4.121 | 4.122 | -0.001 |

| Australian 30-year bond (%) | 4.826 | 4.835 | -0.009 |

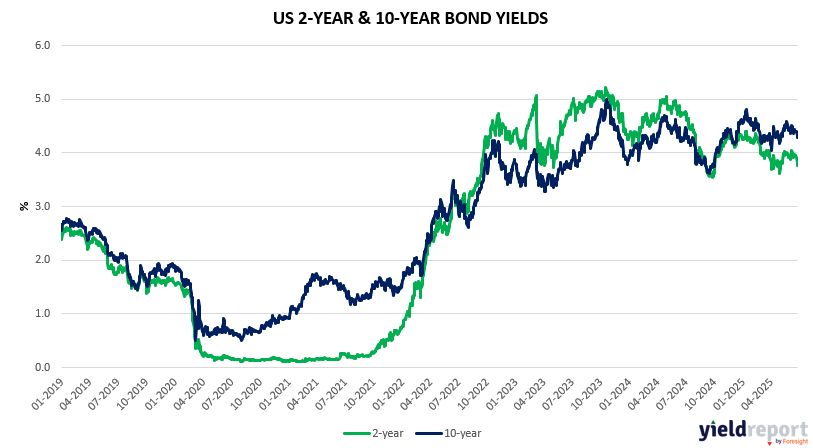

| United States 2-year bond (%) | 3.771 | 3.791 | -0.02 |

| United States 10-year bond (%) | 4.281 | 4.293 | -0.012 |

| United States 30-year bond (%) | 4.8261 | 4.8311 | -0.005 |

Overview of the Australian Bond Market

The Australian bond market experienced modest movements, reflecting broader economic and geopolitical dynamics.

Bloomberg AusBond Composite 0+ Yr Index rose by 0.16%, indicating a slight uptick in bond prices.

Short-term yields declined with the Three-month bank bills falling by 15 basis points to 3.73%. Six-month bank bills dropped 11 basis points to 3.77%.

Government bond yields showed mixed movements. The three-year bonds rose slightly by 1 basis point to 3.33%. Ten-year bonds increased by 9 basis points to 4.26%

The bond market’s mild gains came amid global uncertainty, including trade tensions and geopolitical developments.

The RBA’s cautious tone surprised markets, despite the expected rate cut.

Inflation appears to be stabilising, and the labour market remains resilient, with unemployment steady at 4.1%.

As of late June 2025, market expectations for the Reserve Bank of Australia (RBA) cash rate are clearly tilted toward further easing, driven by soft economic data and moderating inflation.

Financial markets are pricing in a 90% probability of another 25 basis point cut to 3.60% at the July 7–8 RBA meeting. Markets anticipate two more 25 bp cuts by the end of 2025, bringing the cash rate to 3.10%. A final cut to 2.85% is expected in early 2026, which would mark the terminal rate for this easing cycle.

Drivers behind these expectations include:

– Weak GDP growth: Q1 GDP came in at just 0.2% quarterly and 1.3% annually, below RBA forecasts.

– Subdued consumer and business sentiment.

– Disinflation trend: May CPI printed at 2.1%, below expectations.

– Stable unemployment at 4.1%, with no signs of wage pressures.

In the mean, CBA expects a cut to 3.60% in July, followed by another to 3.35% in August. Westpac, NAB, and ANZ have also revised their forecasts to reflect earlier and deeper cuts.

Overview of the US Bond Market

The dollar fell and US Treasuries rallied after a report that President Donald Trump is considering naming Federal Reserve Chair Jerome Powell’s successor well before the incumbent’s term is scheduled to end next May.

The Wall Street Journal said Trump may reveal his pick to run the Fed by September or October. The report follows weeks of lobbying by the president for Powell to lower borrowing costs.

Investors and analysts reckon Powell’s replacement will most likely share the president’s dovish bias, prompting speculation interest rates could eventually fall faster and deeper than markets are currently pricing. An early selection could also confuse markets by forcing them to monitor the monetary policy commentaries of Powell and his replacement.

A rally in short-dated Treasuries gathered pace as a raft of economic data on balance favored wagers on as many as three Fed cuts this year. Traders continued to expect officials to slash rates in September – with two cuts fully priced in by year-end. A third cut is about half priced in. The greenback hit the lowest since 2022.

Bets on lower interest rates are also weighing on the dollar, which weakened against all of its Group-of-10 peers. The Bloomberg’s Dollar Spot Index slumped 0.6% to the weakest level in over three years. Commerzbank forecasts the euro could climb to $1.18 in the coming days if policymakers continue to shift to favor earlier rate cuts.

US consumer spending grew in the first quarter at the weakest pace since the onset of the pandemic on a sharp deceleration in outlays for a variety of services.

Spending on services contributed 0.3 percentage point to gross domestic product in the first three months of the year, the least since the second quarter of 2020, according to Bureau of Economic Analysis figures published Thursday. That was down sharply from a previously reported 0.79 point boost.

Overall consumer spending increased at a 0.5% pace, instead of the previously reported 1.2%. GDP declined at a downwardly revised 0.5% annualized rate in the first quarter as a result.

Demand for U.S. durable goods jumped 16.4% in the month of May, reaching its highest level in 11 years, according to data from the Commerce Department.

The increase, however, comes because transport-equipment new orders soared 48%, despite a continuing, wider slowdown in business investment.

The durable-goods market encompasses all goods made to last at least three years, such as automobiles, planes and electronic equipment. In the past month, orders for nondefense aircraft parts more than doubled amidst a flurry of new Boeing contracts.

.