Summary:

This week, Australian bank ASX-listed hybrids continued to show a stable performance across both standard and non-standard instruments. Among the top performers in terms of running yield were Judo Capital (JDOPA) with 8.87%, Nufarm (NFNG) with 8.67%, and Latitude (LFSPA) with 8.37%, offering attractive income returns for investors.

Day-to-day price movements were modest, with Latitude (LFSPA) gaining 0.20%, followed by Challenger (CGFPC) and NABPF, each up 0.09%. Nufarm (NFNG) and Ramsay Health Care (RHCPA) saw slight declines of 0.07% and 0.11% respectively.

Trading margins remained broadly stable, with Latitude (LFSPA) standing out again at 5.58%, and MQGPG at 1.87%, indicating a mix of high yield and moderate risk-reward dynamics.

Average closing prices hovered near par, though select instruments such as JDOPA (112.95), MQGPF (106.55), and RHCPA (106.6) traded well above, reflecting continued investor confidence.

Overall, the hybrid market maintained its resilience, offering consistent yields and low volatility, reinforcing its appeal as a reliable income-generating option for investors.

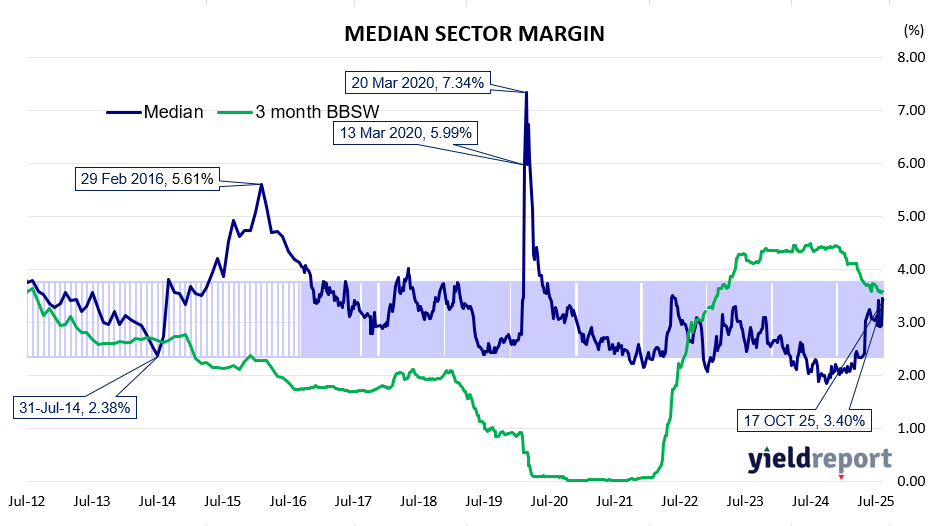

Figure 1: Hybrids: Median Sector Margin

ASX-Listed Hybrids

COMPANY CODE HYBRID TYPE MATURITY/

CALL

DATEMARGIN

INCL. CREDITSTRADING

MARGINDAY

CHANGEDAY

CLOSERUNNING

YIELD**AMP Group AMPPB Capital Notes 2 16/12/2025 4.50% -7.23% -0.39% 100.717 7.91% Macquarie Bank MBLPC Capital Notes 2 22/12/2025 4.70% -4.71% -0.19% 100.42 8.12% Challenger CGFPC Capital Notes 3 25/05/2026 4.60% -1.42% 0.09% 102.75 7.88% Nat Aust Bank NABPF Capital Notes 3 17/06/2026 4.00% -1.05% 0.09% 102.031 7.32% Suncorp SUNPH Capital Notes 3 17/06/2026 3.00% -1.11% 0.09% 101.55 6.39% Macquarie Group MQGPD Capital Notes 4 10/09/2026 4.15% -0.16% 0.07% 102.8 7.43% CBA CBAPJ PERLS 13 20/10/2026 2.75% 0.02% 0.09% 101.6 6.15% Latitude LFSPA Capital Notes 27/10/2026 4.75% 5.58% 0.20% 99.13 8.37% Westpac WBCPJ Capital Notes 7 22/03/2027 3.40% 0.42% 0.07% 102.74 6.69% CBA CBAPI PERLS 12 20/04/2027 3.00% 0.55% 0.07% 102.42 6.34% Bank of Queensland BOQPF Capital Notes 2 14/05/2027 3.80% 0.57% 0.07% 104.2 7.02% Bendigo Bank BENPH Capital Notes 15/06/2027 3.80% 0.63% 0.06% 103.75 7.01% Macquarie Group MQGPE Capital Notes 5 20/09/2027 2.90% 0.93% 0.05% 102.56 6.24% Nat Aust Bank NABPH Capital Notes 5 17/12/2027 3.50% 1.05% 0.05% 103.68 6.73% ANZ Bank AN3PI Capital Notes 6 20/03/2028 3.00% 1.35% 0.04% 102.75 6.33% CBA CBAPL PERLS 15 15/06/2028 2.85% 1.32% 0.05% 102.633 6.19% Suncorp SUNPI Capital Notes 4 17/06/2028 2.90% 1.26% 0.05% 102.85 6.22% Westpac WBCPL Capital Notes 9 22/09/2028 3.40% 0.99% 0.04% 105 6.55% Macquarie Bank MBLPD Capital Notes 3 7/12/2028 2.90% 1.42% 0.03% 103.36 6.21% Bank of Queensland BOQPG Capital Notes 3 15/12/2028 3.40% 1.44% 0.04% 104.31 6.60% Judo Capital JDOPA Capital Notes 16/02/2029 6.50% 1.76% 0.05% 112.95 8.87% ANZ Bank AN3PJ Capital Notes 7 20/03/2029 2.70% 1.54% 0.03% 102.65 6.05% Challenger CGFPD Capital Notes 4 25/05/2029 3.60% 1.34% 0.04% 106.29 6.69% CBA CBAPK PERLS 14 15/06/2029 2.75% 1.22% 0.04% 103.84 6.02% Insurance Australia IAGPE Capital Notes 2 15/06/2029 3.50% 1.65% 0.03% 104.88 6.67% Macquarie Group MQGPF Capital Notes 6 12/09/2029 3.70% 1.44% 0.03% 106.55 6.76% Nat Aust Bank NABPI Capital Notes 6 17/09/2029 3.15% 1.38% 0.04% 104.8 6.34% Westpac WBCPK Capital Notes 8 21/09/2029 2.90% 1.24% 0.03% 104.4 6.12% ANZ Bank AN3PK Capital Notes 8 20/03/2030 2.75% 1.51% 0.02% 103.75 6.03% CBA CBAPM PERLS 16 17/06/2030 3.00% 1.28% 0.03% 105.61 6.15% Suncorp SUNPJ Capital Notes 5 17/06/2030 2.80% 1.55% 0.03% 103.8 6.07% Nat Aust Bank NABPJ Capital Notes 7 17/09/2030 2.80% 1.53% 0.03% 104.1 6.05% Bendigo Bank BENPI Capital Notes 2 13/12/2030 3.20% 1.59% 0.03% 105.61 6.34% Insurance Australia IAGPF Capital Notes 3 47832 0.032 0.018184375 0.00025229 104.9 0.063921564 ANZ Bank AN3PL Capital Notes 9 47927 0.029 0.016031369 0.00021319 104.8 0.061148845 Westpac WBCPM Capital Notes 10 48113 0.031 0.015394307 0.000273408 106.05 0.062099942 Macquarie Group MQGPG Capital Notes 7 48197 0.0265 0.018716387 0.000234099 102.96 0.059822922 Nat Aust Bank NABPK Capital Notes 8 48290 0.026 0.012820475 0.000240101 105.58 0.057801513 ASX-Listed Hybrids (Non-standard)

COMPANY CODE BOND TYPE CALL DATE ISSUE MARGIN (inc frank) TRADING MARGIN DAY CLOSING PRICE RUNNING YIELD Nufarm NFNG Step Up Perpetual 3.90% 5.10% -0.07% 88.5 8.67% Ramsay Health Care RHCPA Preference Share Perpetual 4.85% 4.51% -0.11% 106.6 8.08%