Equities_18.07.25.csv

| Name | Daily Close | Daily Change | Daily Change (%) |

|---|---|---|---|

| Dow | 44,342.19 | -142.3 | -0.32% |

| S&P 500 | 6,296.79 | -0.57 | -0.01% |

| Nasdaq | 20,895.66 | 10.01 | 0.05% |

| VIX | 16.41 | -0.11 | -0.67% |

| Gold | 3,355.40 | 10.1 | 0.30% |

| Oil | 67.31 | -0.23 | -0.34% |

OVERVIEW OF THE US MARKET

US stocks ended nearly flat on Friday, July 18, 2025, as investors took profits after a strong week, with focus shifting to Trump’s 30% tariff threats on EU and Mexico goods set for August 1 and next week’s key data releases. Treasury yields dipped slightly, and the dollar softened, with markets reflecting caution ahead of the weekend.

The S&P 500 slipped 0.01% to 6,296.79, while the Nasdaq Composite edged up 0.05% to 20,895.66, showing mixed sector performance. Consumer Discretionary rose 0.98%, led by QuantumScape’s 7.65% gain to $14.64, while Utilities climbed 1.71%. Information Technology dipped 0.10%, with Nvidia down 0.34% to $172.41 on 146.5 million shares. Lucid Group (LCID) fell 2.56% to $3.04 after its recent surge.

The week’s positive data, including Thursday’s retail sales up 0.6% and Philly Fed Index at 15.9, bolstered sentiment, though import prices dropping 0.2% year-over-year eased inflation concerns. Markets still price two rate cuts by year-end, with September favoured, but Trump’s tariffs loom large. Next week’s housing starts on Monday at 10:30 PM AEST will be critical, alongside ongoing trade negotiations.

OVERVIEW OF THE AUSTRALIAN MARKET

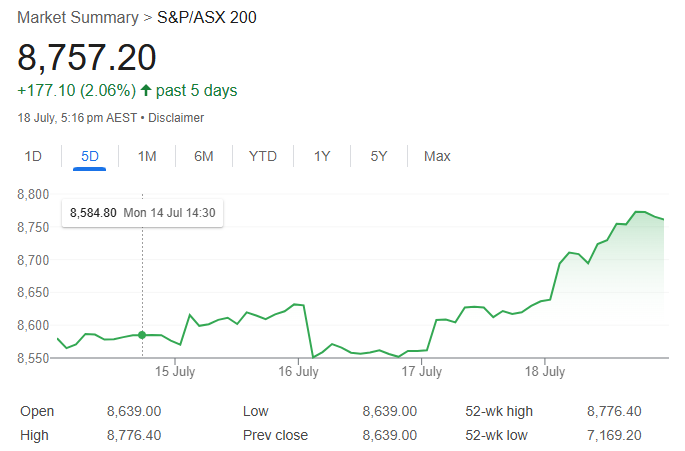

The ASX 200 achieved its third record close this week, surging 1.37% to 8,757.2 on Friday, July 18, 2025, driven by broad gains and optimism from Prime Minister Anthony Albanese’s China visit, despite a 0.21% rise in the Australian dollar to 0.6502. The index hit an intraday high of 8,776.40, with weekly gains of 2.1%, the strongest since May.

All 11 sectors rose, led by Health Care (+2.47%)—CSL up 3.6% to $257.38 and Mesoblast soaring 34.7% to $2.41—and Materials (+2.06%), with BHP rallying 3.0% to $40.29 on record production. Financials gained 1.17%, with banks up 1-2%, though CBA lagged at 0.9%. Tech rose 1.50%, reflecting robust breadth, with 84% of ASX 200 stocks flat or higher.

Albanese’s China talks boosted trade hopes, countering tariff fears, while the market’s resilience signals confidence amid global uncertainties. The All Ordinaries hit 9,006.8, a historic milestone, with year-to-date gains at 6.5%.