Summary: ANZ to issue new hybrid security, AN3PK; expected to initially pay around 6.25% (annualised, including franking credits); likely issue margin 2.75%; 5bps above current median sector margin; first call date in March 2030; trading expected to begin on 27 March 2023.

In recent years, when one of a company’s existing hybrids approaches its first call date (or first optional exchange date), speculation turns to the likelihood of a replacement hybrid security. A replacement security makes sense given APRA regulations require banks and other financial institutions to maintain equity capital above certain minimum ratios of assets.

ANZ’s latest hybrid security offer is in keeping with this tradition as its Capital Notes 3 (AN3PF) are approaching the March 2023 call date and will be redeemed at ANZ’s option.

ANZ plans to raise $1 billion via an issue of Capital Notes 8 securities (code: AN3PK), with the ability to raise more or less than this amount. The new securities will be perpetual, convertible, subordinated, unsecured, redeemable notes and the proceeds will be used to finance the redemption of AN3PF securities and for “general corporate purposes”.

The new notes have some features in common with both equities and debt securities. Distributions are at the discretion of directors but they are calculated according to a set formula with reference to the $100 face value of the securities. In the event ANZ were wound up, its hybrids would rank above ordinary shares but below ordinary debt securities and other liabilities. However, the existence of a “write-off” clause implies the hybrids would likely no longer exist should ANZ find itself in this position.

The capital notes will have an indicative distribution rate equivalent to 3-month BBSW plus a margin which lies in a range from 275bps to 300bps. The final margin will be determined by a “book build” and the result will be announced on 22 February 2023. A book build is a tender process managed by investment banks on behalf of the issuer in which investment institutions place bids for a set volume at a price/yield.

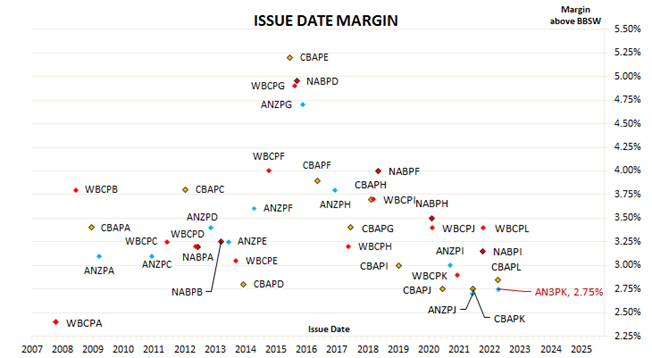

The chart above shows the history of issue margins of hybrid securities over the last fifteen years or so, including the GFC period in 2008/2009. ANZ’s likely margin is at the lower bound of the range.

Distributions will be non-cumulative, at the discretion of directors and paid quarterly in arrears. However, should a distribution not be paid, ANZ cannot declare or pay a dividend on its ordinary shares. It would also not be allowed to undertake any buy-back or a capital reduction of its ordinary shares.

At the prevailing level of interest rates and if the margin is at the lower end of the range, the new notes will initially pay around 6.25%* (annualised) inclusive of franking credits. *As interest rates change, specifically the bank bill swap rate, quarterly payments will also change.

The first call date is 20 March 2030. This is the first date at which ANZ can exchange all or some of the securities in the absence of a “Common Equity Trigger Event”, “Non-Viability Trigger Event”, “Change of Control Event” or some other “event” as stated in the product disclosure statement.

The scheduled mandatory exchange date is 20 September 2032. Exchange, in the context of listed hybrids, may mean redeem, resell to a third party or convert into ordinary shares.

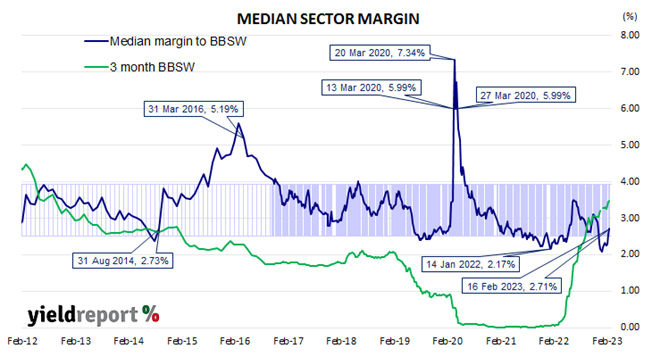

Issue margins are set close to the margins of comparable hybrids already trading on the ASX. Readers will see ANZ’s likely issue margin is at the lower part of the band which captures the majority of median margin readings from 2011. It would also be about the same as the current median sector margin.

From late-2015 through to early 2017, hybrid margins blew out as doubts emerged over the sturdiness of a hybrid structure in an economic downturn. They gradually fell back over the following three years, drifting down to below the long-term channel (see above) just before the March 2020 spike. The median margin of hybrids currently listed on the ASX at the close of business on 16 February was about 2.70%.

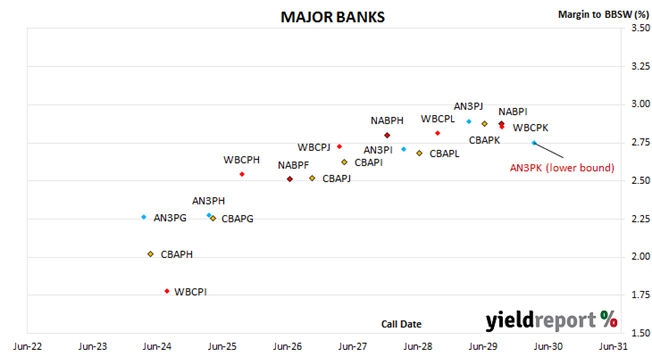

Prices for securities change as soon as trading begins, whether it is on an organised market such as the ASX or an over-the-counter (OTC) market. Other securities issued at different margins may have fallen (or risen) in price, which generally means their margins will have changed. The chart below shows the margins of comparable securities which trade on the ASX as at the close of business on 16 February 2023.

YieldReport has explained the meaning of “margin” in previous articles so for those readers who are not familiar with the term or who just want a refresher explanation, click here.

There will be an institutional offer and an offer1 to clients of joint lead managers, co-managers or syndicate brokers to the issue who may apply via the “broker firm” offer2. There will be no “securityholder” offer nor an offer to the general public but there will be a “Reinvestment” offer, where eligible1,2 Capital Note 3 holders may apply through a syndicate broker.

Trading on the ASX is expected to begin on 27 March 2023.

1 Must not be in the US or acting for persons in the US.

2 Must be a “wholesale” investor or an investor who has received personal financial product advice from a licensed professional adviser to acquire ANZ Capital Notes 8. Applications must be made through a syndicate broker.