Summary

The Reserve Bank of Australia (RBA) held the cash rate steady at 3.6% during its October 2025 meeting. Governor Michele Bullock emphasized a cautious but optimistic outlook, citing signs of recovery in consumption and labour markets. Inflation remains within the target band, though pressures from services and housing persist. The RBA refrained from forward guidance, opting for a data-dependent approach. Markets and government commentary have shifted expectations, with fewer anticipating further rate cuts. The next policy decision will be informed by updated CPI data and labour market indicators in November.

Monetary Policy Decision

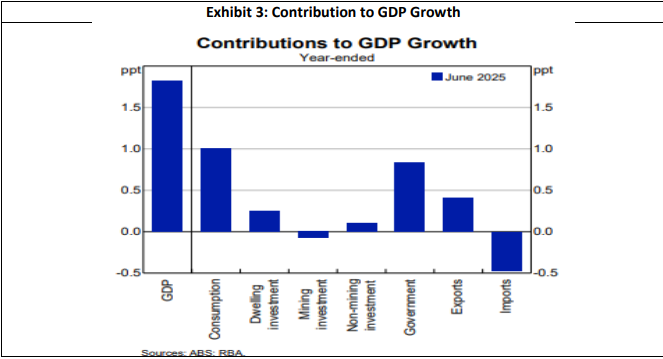

The RBA’s decision to hold the cash rate at 3.6% reflects a balancing act between supporting growth and containing inflation. The Board noted that previous rate cuts have begun to ease financial conditions, but emphasized the lagged nature of monetary transmission. The exhibit 1 visually captures the recent rate trajectory and the current pause. The RBA Board opted to keep the cash rate unchanged, marking the fourth consecutive meeting without a rate hike. This decision follows three rate cuts earlier in 2025, which are beginning to show effects, though the full impact is still unfolding due to policy lags. Exhibit 1: Aust Cash Rate Target

Inflation Outlook

Inflation remains within the target band, but the RBA is closely monitoring services inflation and housing costs. Governor Bullock highlighted that while inflation is not accelerating uncontrollably, the elevated price levels are a concern. While inflation remains within the 2–3% target band, recent data—particularly from market services and housing—suggest upward pressure may be stronger than anticipated. The RBA emphasized that price levels remain permanently elevated, and the focus is on slowing the rate of increase, not reversing prices.

Labour Market Conditions

The labour market shows signs of tightness, with stable unemployment but persistent underutilization. Wage growth has moderated, yet unit labour costs remain elevated, suggesting sectored imbalances. Employment growth has slowed, but the unemployment rate holds at 4.2%, indicating a still-tight labour market. Wage pressures have eased slightly, though unit labour costs remain high.

Consumption and Wealth Effects

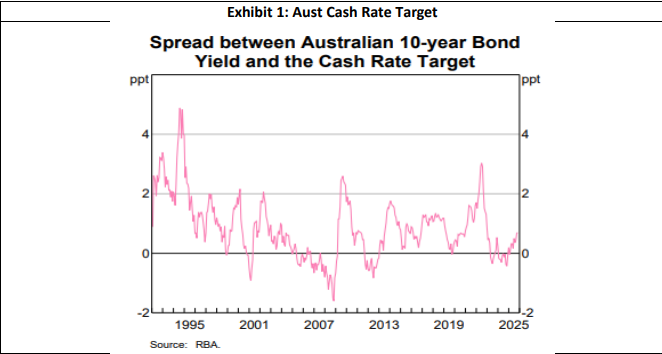

Household consumption has rebounded, driven by rising real incomes and asset prices. The RBA acknowledged the wealth effect from housing and superannuation, which is feeding into spending behavior. Exhibit 2 shows trends in disposable income, consumption, and saving ratio. The RBA acknowledged a rebound in household consumption, supported by rising real incomes and asset prices. The wealth effect—from housing and superannuation gains—is contributing to increase spending. Exhibit 2: Household Income & Consumption

Forward Guidance and Policy Stance

Governor Bullock reiterated the RBA’s data-dependent approach, avoiding explicit forward guidance. The Board considers policy to be slightly restrictive but appropriate given current conditions. Governor Bullock refrained from offering explicit forward guidance, stressing a datadependent approach. The Board views policy as slightly restrictive, but not excessively so.

Government and Market Reactions

Market participants have recalibrated expectations, with fewer anticipating further rate cuts. The RBA acknowledged stronger-than-expected inflation data as a key driver of this shift. While the RBA did not directly reference government commentary, economists and markets have adjusted expectations. Earlier forecasts of further rate cuts have been tempered by stronger-than-expected inflation data.

Looking Ahead

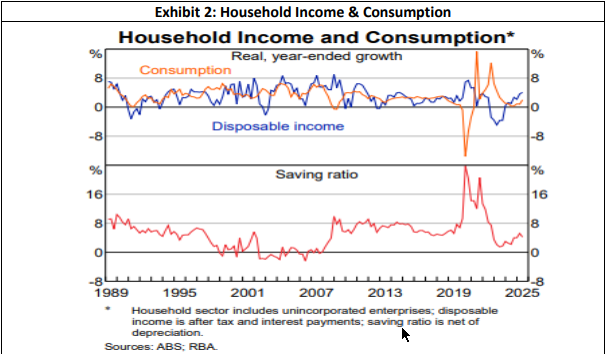

The RBA will reassess conditions in November, incorporating new labour and inflation data. The transition to full monthly CPI reporting will enhance policy responsiveness. The following exhibit 3offers insight into sectored drivers of economic momentum. The RBA will reassess in November, with new data on labour markets, inflation, and forwardlooking indicators. The transition to a full monthly CPI from the ABS will also influence future decisions.