![]()

Commentary courtesy of Spectrum Asset Management’s Lindsay Skardoon.

| Close | Prev Close |

Change | |

| Aust. 90 day bank bill% | 1.78 | 1.78 | 0.00 |

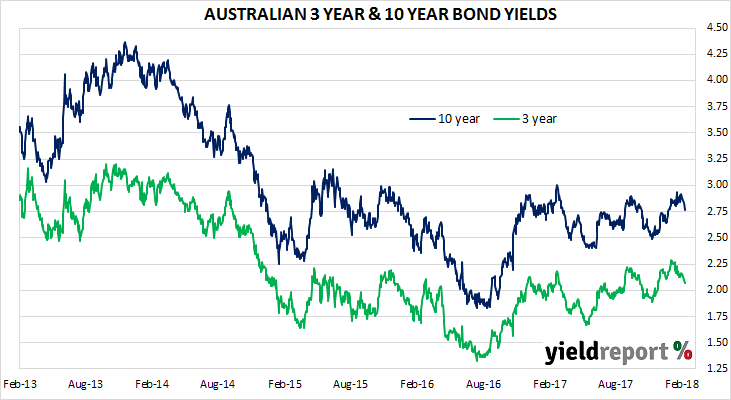

| Aust. 3 year bond%* | 2.07 | 2.10 | -0.03 |

| Aust. 10 year bond%* | 2.77 | 2.83 | -0.06 |

| Aust. 20 year bond%* | 3.20 | 3.27 | -0.07 |

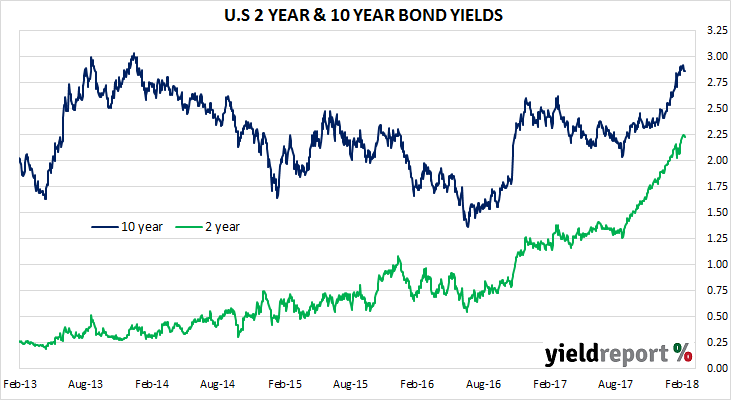

| U.S. 2 year bond% | 2.23 | 2.25 | -0.02 |

| U.S. 10 year bond% | 2.86 | 2.87 | -0.01 |

| U.S. 30 year bond% | 3.15 | 3.16 | -0.01 |

| * Implied yields from Mar 2018 futures | |||

LOCAL MARKETS

U.S. BOND MARKETS

Bond investors are largely positioned by way of consensus. They are all expecting bond yields to rise, have massive short positions on the 10-year but bonds keep rallying, why? That’s because everyone is basically short, and we are seeing some short covering. Asset allocators, hedge funds and traders are all short, however, the market for the moment is rallying. The balance of risks is shifting. Bond investors at present are not fearing inflation so much as increasing deficits and increased issuance. For the moment, however, the bond investors have not crowded into wrong way bets. Markets, however, have a habit of changing quickly.

For the moment the U.S. 10-year looks attractive compared to bonds elsewhere. The U.S. economy is growing steadily at around 2-2.5% depending and the environment looks attractive for investors, but how long can this continue? That’s where expectations and consensus come to play.