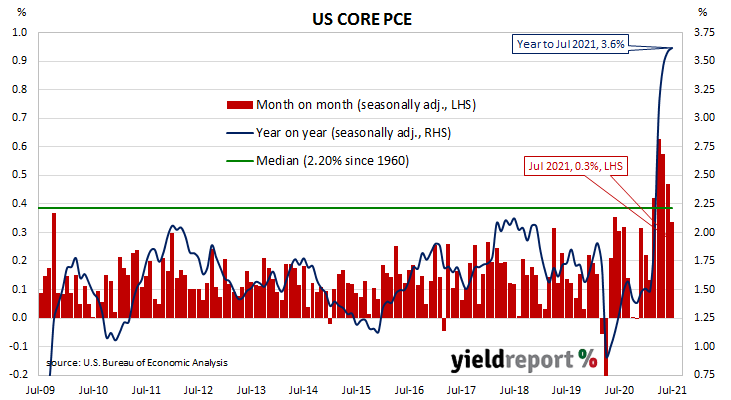

Summary: US Fed’sfavoured inflation measure increases by 0.3% in July, in line with market expectations; annual rate steadies at 3.6%; Treasury bond yields lower following Powell comments.

One of the US Fed’s favoured measures of inflation is the change in the core personal consumption expenditures (PCE) price index. After hitting the Fed’s target at the time of 2.0% in mid-2018, the annual rate then hovered in a range between 1.8% and 2.0% before it eased back to a range between 1.5% and 1.8% through 2019. It then plummeted below 1.0% in April 2020 before rising back to around 1.5% in the September quarter of that year. It has since spiked up to above 3% in the June 2021 quarter.

The latest figures have now been published by the Bureau of Economic Analysis as part of the July personal income and expenditures report. Core PCE prices rose by 0.3% over the month, in line with the generally expected figure but less than June’s 0.5% increase. On a 12-month basis, the core PCE inflation rate remained unchanged at 3.6% after revisions.

US Treasury bond yields fell moderately on the day following comments by Jerome Powell which was viewed as “dovish” at the Jackson Hole symposium. By the close of business, the 2-year Treasury bond yield had slipped 1bp to 0.23%, the 10-year yield had lost 4bps to 1.31% while the 30-year yield finished 3bps lower at 1.92%.

The core version of PCE strips out energy and food components, which are volatile from month to month, in an attempt to identify the prevailing trend. It is not the only measure of inflation used by the Fed; it also tracks the Consumer Price Index (CPI) and the Producer Price Index (PPI) from the Department of Labor. However, it is the one measure which is most often referred to in FOMC minutes.