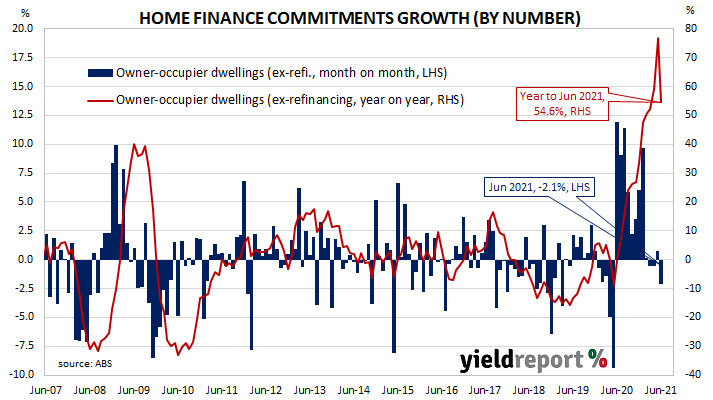

Summary: Number of home loan approvals decline by 2.1% in June; likely to weaken without HomeBuilder but low interest rates providing support “for some time”; value of loan commitments decrease by 1.6%; value of owner-occupier loan approvals down by 1.9%, investor approvals up by 0.7%; coming off high base; “some moderation” expected in September quarter; COVID-related disruptions not fully apparent until lock-downs end.

A very clear downtrend was evident in the monthly figures of both the number and value of home loan commitments through late-2017 to mid-2019. Then the RBA reduced its cash rate target in a series of cuts and both the number and value of mortgage approvals began to noticeably increase. Figures from February through to May of 2020 provided an indication the trend had finished but subsequent figures pushed the annual rate of increases back into positive territory and then on elevated levels.

June’s housing finance figures have now been released and the total number of loan commitments (excluding refinancing loans) to owner-occupiers declined by 2.1%. The fall came after a 0.8% rise in May after revisions while the rate of growth on an annual basis decreased from May’s figure of 76.8% to 54.7%.

“While house approvals are likely to weaken without HomeBuilder, ongoing low interest rates are likely to support housing finance for some time,” said ANZ economist Adelaide Timbrell.

The figures were released on the same day as June’s building approval numbers and the RBA Board’s August meeting. Longer-term Commonwealth bond yields fell on the day, largely in line with overnight movements in US Treasury markets. By the close of business, the 10-year ACGB yield had shed 3bps to 1.15% and the 20-year yield had lost 2bps to 1.79%. The 3-year yield ticked up 1bp to 0.29%.

In dollar terms, total loan approvals excluding refinancing decreased by 1.6% over the month, a result which contrasted with May’s 4.9% increase. On a year-on-year basis, total approvals excluding refinancing increased by 82.7%, somewhat slower than the previous month’s comparable figure of 95.4%.

The total value of owner-occupier loan commitments excluding refinancing fell by 1.9%, down from May’s 2.5% increase. On an annual basis, owner-occupier loan commitments were 75.9% higher than in June 2020, whereas May’s annual growth figure was 88.4%.