Summary: Euro-zone composite sentiment indicator up a touch in November, slightly above expectations; German, French 10-year yields moved lower; readings up in three of five sectors; up in two of four largest euro-zone economies; index implies annual GDP growth rate of 0.6%.

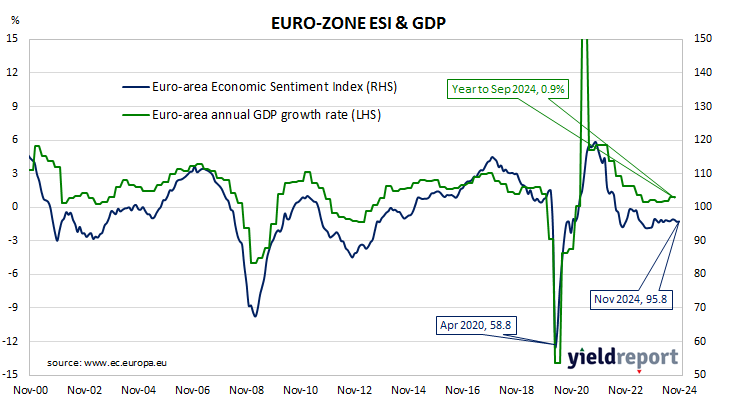

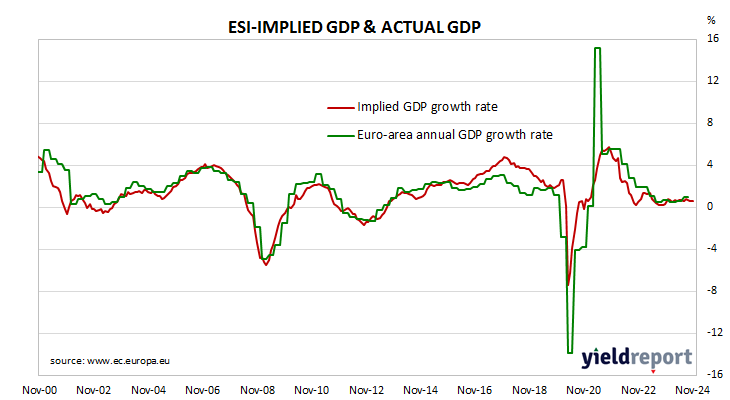

The European Commission’s Economic Sentiment Indicator (ESI) is a composite index comprising five differently weighted sectoral confidence indicators. It is heavily weighted towards confidence surveys from the business sector, with the consumer confidence sub-index only accounting for 20% of the ESI. However, it has a good relationship with euro-zone GDP growth rates, although not necessarily as a leading indicator.

According to the latest survey taken by the European Commission, confidence has improved a touch on average across the various sectors of the euro-zone economy in November. The ESI posted a reading of 95.8, slightly above the generally expected figure of 95.2 as well as October’s revised reading of 95.7. The average reading since 1985 is just under 100.

Long-term German and French 10-year bond yields moved lower on the day. By the close of business, the German 10-year yield had lost 4bps to 2.13% while the French 10-year yield finished 8bps lower at 2.94%.

Confidence improved in three of the five sectors of the euro-zone economy. On a geographical basis, the ESI increased in two of four of the euro-zone’s largest economies.

End-of-quarter ESI readings and annual euro-zone GDP growth rates are highly correlated. This latest reading corresponds to a year-to-November GDP growth rate of 0.6%, unchanged from October’s implied growth rate.