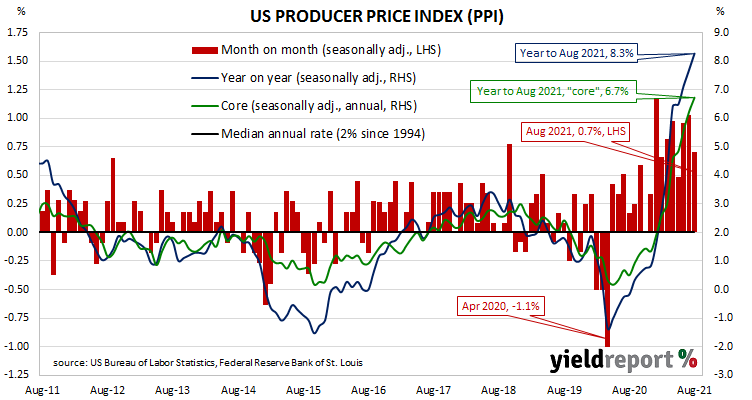

Summary: Prices received by US producers rise by 0.7% in August, just above expected figure; annual rate increases to 8.3%; “core” PPI increases by 0.6%; services prices up 0.7%, goods up 1.0%; “ongoing supply, restocking issues in US economy”.

Around the end of 2018, the annual inflation rate of the US producer price index (PPI) began a downtrend which continued through 2019. Months in which producer prices increased suggested the trend may have been coming to an end, only for it to continue, culminating in a plunge in April 2020. Figures returned to “normal” towards the end of that year but recent months’ annual rates have been well above average.

The latest figures published by the Bureau of Labor Statistics indicate producer prices rose by 0.7% after seasonal adjustments in August. The increase was just above the 0.6% rise which had been generally expected but less than July’s 1.0% increase. On a 12-month basis, the rate of producer price inflation after seasonal adjustments increased from 7.7% to 8.3%.

PPI inflation excluding foods and energy, or “core” PPI inflation, rose by 0.6% after seasonal adjustments, less than July’s 1.0% increase. The annual rate accelerated again, this time from 6.2% to 6.7%.

US Treasury bond yields rose moderately on the day. By the end of it, the 2-year Treasury yield had inched up 1bp to 0.22%, the 10-year yield had gained 4bps to 1.34% while the 30-year yield finished 3bps higher at 1.93%.

The BLS stated higher prices for final demand services led the month’s increase after they rose by 0.7% on average. Prices of final demand goods rose by 1.0%.

NAB currency strategist Rodrigo Catril noted changes in wholesaler and retailer margins “accounted for two-thirds of the broad rise” in the services index. He also pointed to higher transportation and warehousing prices as a reflection of “ongoing supply and restocking issues in the US economy.”

The producer price index (PPI) is a measure of prices received by producers for domestically produced goods, services and construction. It is put together in a fashion similar to the consumer price index (CPI) except it measures prices received from the producer’s perspective rather than from the perspective of a retailer or a consumer. It is another one of the various measures of inflation tracked by the US Fed, along with core personal consumption expenditure (PCE) price data.