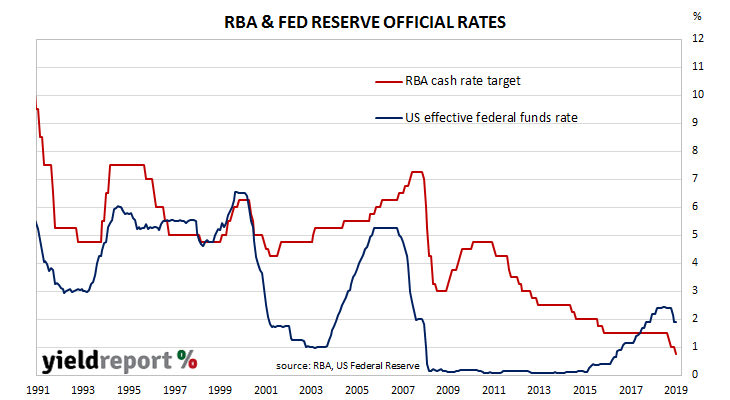

The RBA reduced its official cash rate target for the third time in 2019 at its October board meeting. The rate at which the RBA wishes banks to lend to each in the market for unsecured overnight loans was lowered from 1.00% to 0.75%.

Around February of this year, the RBA began to publicly move away from a tightening bias. By April, “there was not a strong case for a near-term adjustment in monetary policy” and, by May, the transformation to an easing bias had been completed. In June, a 25bps rate cut was announced and another one followed in July.

The RBA then took a breather and no changes were made at the RBA’s August and September board meetings. However, it then moved again at its October meeting.

The minutes of that meeting have now been released and the board’s deliberations focussed on a rationale for a rate cut. While some members were “mindful” of various factors which may present reasons not to lower the cash rate target, they “concluded that these various factors did not outweigh the case for a further easing of monetary policy at the present meeting.” One interesting observation which arose out of the minutes relates to the effect of lower interest rates on asset prices. The minutes noted the possibility “prices might be overly inflated by lower interest rates.” However, as far as the RBA is concerned, higher prices provide the incentive for people to build and invest. “Members acknowledged that asset prices were part of the transmission mechanism of policy, including by encouraging home building.” It seems the RBA would only be concerned “if rapidly increasing asset prices were accompanied by materially faster credit growth, weak lending standards and rising leverage.”

One interesting observation which arose out of the minutes relates to the effect of lower interest rates on asset prices. The minutes noted the possibility “prices might be overly inflated by lower interest rates.” However, as far as the RBA is concerned, higher prices provide the incentive for people to build and invest. “Members acknowledged that asset prices were part of the transmission mechanism of policy, including by encouraging home building.” It seems the RBA would only be concerned “if rapidly increasing asset prices were accompanied by materially faster credit growth, weak lending standards and rising leverage.”