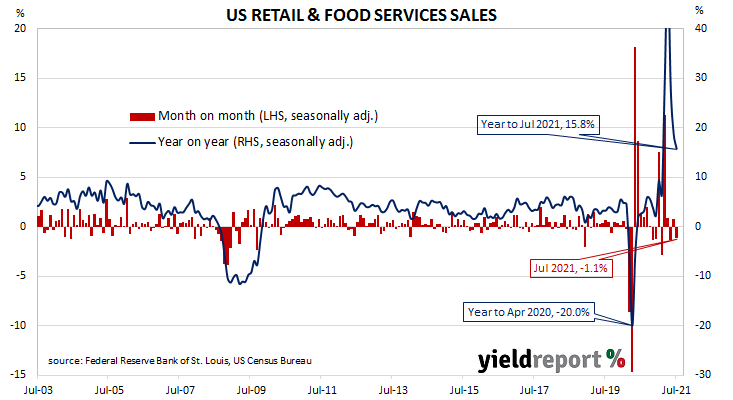

Summary: US retail sales fall by 1.1% in July; fall larger than expected -0.2%; weakness likely reflects shift in consumption patterns, higher goods prices, Delta spread; falls in majority of retail categories; “vehicles and parts” the largest single influence, falls 3.9%.

US retail sales had been trending up since late 2015 but, commencing in late 2018, a series of weak or negative monthly results led to a drop-off in the annual growth rate below 2.0%. Growth rates then increased in trend terms through 2019 and into early 2020 until pandemic restrictions sent it into negative territory. A “v-shaped” recovery then took place which was followed by some short-term spikes as federal stimulus payments hit US households in early 2021.

According to the latest “advance” sales numbers released by the US Census Bureau, total retail sales decreased by 1.1% in July. The fall was considerably larger than the 0.2% decline which had been generally expected and in contrast to June’s 0.7% rise after it was revised up from +0.6%. On an annual basis, the growth rate slowed from June’s revised figure of 18.7% to 15.8%.

“In part, weakness likely reflects a shift in consumption patterns away from goods to services. High goods prices and the spread of the Delta variant are likely to have made consumers a little more cautious too,” said ANZ economist Rahul Khare.

The majority of categories recorded lower sales over the month. Once again, the “Motor vehicle & parts dealers” segment provided the largest single influence on the overall result, falling by 3.9% for the month while still remaining 15.7% higher for the year. Sales at ”non-store retailers” also had a significant influence on the total, falling by 3.1%.

NAB currency strategist Rodrigo Catril attributed lower vehicle sales to higher prices “amid higher demand and lower supply of vehicles.” He noted a similar feature with regards to furniture, sporting goods and building materials “as home prices continued to rise.”