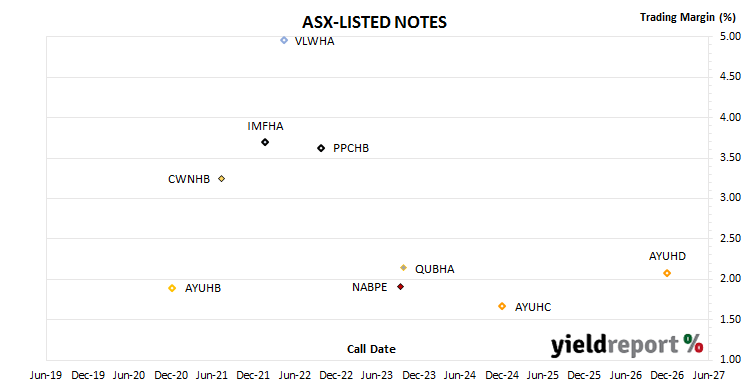

Trading margins of ASX-listed notes and bonds remained fairly stable on average, with four falls and five rises. Trading margins of most securities in the sector varied within a modest range, with the exception of Australian Unity series B Bonds (ASX code: AYUHB, -32bps). These bonds have just over a year to maturity and trading margins of short-dated securities can be rather volatile.

NAOS Small Cap Opportunities (ASX code: NSC), a small cap listed-investment company, issued an Optional Redemption Notice for its Contango Convertible Notes (ASX code: NSCG), giving notice of its intention to redeem the notes on 18 December 2019. The redemption will be financed with a $27 million issue of December 2024 notes issued in the local wholesale market. The notes ceased trading on Friday 6 December.

The current 3-month BBSW rate is around 0.90%. Add the trading margin from the above chart or from the tables to 0.90% for an estimate of the gross return per annum in the absence of BBSW rate changes. The gross return may contain imputation credits. BBSW typically is around 15bps (average since 1990) more than the RBA rate.

ASX-LISTED FLOATING RATE NOTES

| COMPANY | CODE | BOND TYPE | MATURITY | ISSUE MARGIN | TRADING MARGIN | Δ WEEK | WEEK CLOSE | RUNNING YIELD** |

|---|---|---|---|---|---|---|---|---|

| Australian Unity | AYUHB | Bond Series B | 15-Dec-20 | 2.80% | 1.90% | -0.32% | 101.50 | 3.67% |

| Crown | CWNHB | Sub. Note | 23-Jul-21 | 4.00% | 3.25% | 0.02% | 101.10 | 4.84% |

| Bentham IMF | IMFHA | Bond | 31-Jan-22 | 4.20% | 3.69% | 0.15% | 101.99 | 5.04% |

| Villa World | VLWHA | Snr. Bond | 21-Apr-22 | 4.75% | 4.96% | 0.03% | 100.00 | 5.67% |

| Peet | PPCHB | Bond | 5-Oct-22 | 3.65% | 3.63% | 0.04% | 103.70 | 5.40% |

| Nat. Aust. Bank | NABPE | Sub. Note Tier 2 | 20-Jun-23 | 2.20% | 1.91% | -0.07% | 101.80 | 3.07% |

| Qube Holdings | QUBHA | Sub. Note | 5-Oct-23 | 3.90% | 2.14% | 0.07% | 106.95 | 4.52% |

| Australian Unity | AYUHC | Bond Series C | 15-Dec-24 | 2.00% | 1.67% | -0.06% | 102.00 | 2.86% |

| Australian Unity | AYUHD | Bond Series D | 15-Dec-26 | 2.15% | 2.08% | -0.06% | 101.00 | 3.03% |