Summary –

The ASX-listed Floating Rate Notes (FRNs) market remains a niche but increasingly relevant segment for yield-focused investors seeking protection against rising interest rates. Instruments like Centuria Capital’s C2FHA stand out with a trading margin of 8.19% and a running yield of 7.90%, reflecting either elevated credit risk or strong demand for short-duration, high-yield exposure. Meanwhile, Australian Unity’s AYUHD and AYUHE notes offer more moderate yields in the 5.8%–6.2% range, with tighter margins and longer maturities, appealing to investors prioritizing credit stability and duration balance.

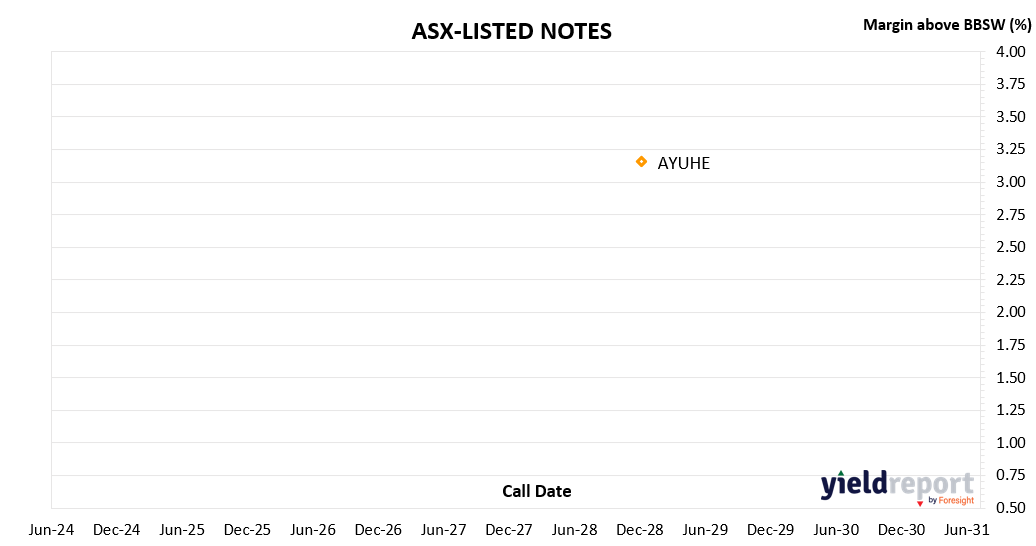

The accompanying chart highlights AYUHE’s position with a 3.25% margin above BBSW and a call date around June 2027, placing it in the mid-range of the FRN universe. This visual reinforces the limited issuance in the listed FRN space and the potential for price discovery as more notes enter the market. Overall, the data suggests a clear tiering among issuers, with spreads reflecting both credit perception and liquidity, while the floating-rate structure continues to attract tactical allocations amid elevated short-term rates.

| COMPANY | CODE | BOND TYPE | MATURITY | ISSUE MARGIN | TRADING MARGIN | Δ WEEK | WEEK CLOSE | RUNNING YIELD** |

|---|---|---|---|---|---|---|---|---|

| Centuria Capital | C2FHA | Note | 20-Apr-26 | 4.25% | 6.81% | 4.12% | 102.4 | 7.95% |

| Australian Unity | AYUHD | Bond Series D | 15-Dec-26 | 2.15% | 4.41% | 1.90% | 100.45 | 5.89% |

| Australian Unity | AYUHE | Bond Series E | 15-Dec-28 | 2.50% | 3.02% | 0.75% | 101.89 | 6.17% |

For a full breakdown of trading activity, margin changes, and performance insights, visit the