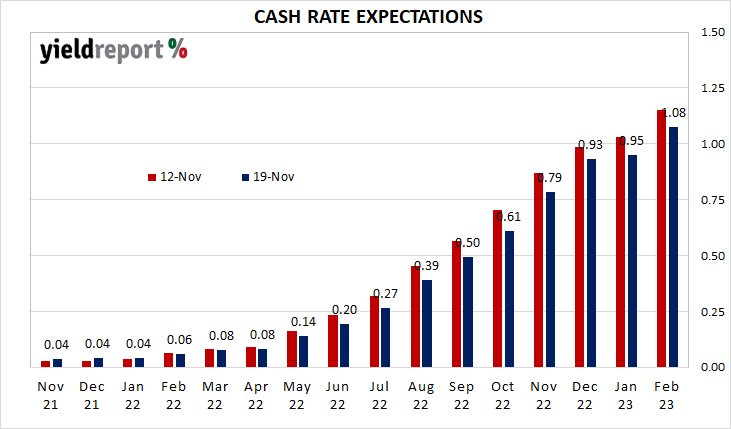

Summary: Cash rate expectations path slightly flatter; cash rate now expected to average 0.93% in December 2022; domestic data neutrally received; one reduction to ADI cash rates in survey.

Since March 2020, the RBA has not enforced its cash rate target by draining liquidity from the banking system via changes in the total of ESA balances. As a result, the actual cash rate, currently at 0.04%, has been noticeably below the target rate, even after the RBA reduced this target to 0.10%. As such, contract prices only reflect expectations of the average actual cash rate in a given month and not some estimate of the likelihood of the RBA changing its target.

Expectations moved to reflect a slightly flatter path for the actual cash rate through the remainder of 2021 and into 2022 in comparison to its path at the end of the previous week. At the end of the week, contracts implied the cash rate would rise slowly but steadily from the current rate of 0.040% to 0.08% by April 2022 and then increase at a faster rate through to December 2022 where that month’s contract price implied an average rate of 0.93%. A week ago, the December 2022 contract’s price implied an average rate of 0.99%.

The RBA can change the overnight cash rate target on any day of its choosing and it has done so on occasion in the past. However, past changes have typically been announced on the day of its Board meeting. Changes have been made much more frequently in the months of February, May, August and November.

Economic data or events which had the potential to affect domestic interest rate expectations were received as broadly neutral.

The minutes of the November RBA board meeting were released on Tuesday. There were nothing particularly surprising in them but Governor Lowe did expand on his views regarding wages, inflation and the RBA’s likely response as they rose in a speech later that day.

Midweek, the September quarter Wage Price Index report met expectations. Observers noted increases were limited to some sectors and were not broad-based.

Westpac and the Melbourne Institute released the October reading of their leading index on the same day. The annualised growth rate remained unchanged at a negative level, which implies below-trend GDP-growth over the next 3-6 months.

3 month BBSW is a useful benchmark for cash rates and it finished the week 1bps higher at 0.05%. Currently, the RBA’s target for the overnight lending rate between banks is 0.10% but actual overnight interbank loans are being negotiated at 0.04%, 4bps above the RBA’s exchange settlement account (ESA) rate for ADI deposits with it.

There was one no change made by a deposit-taking institution in our survey of cash account interest rates this week. Bankwest reduced its Smart eSaver rate by 15bps.

CASH ACCOUNTS

| Product | Interest Rate p.a. | Special Conditions |

|---|---|---|

| AMP Saver Account | 0.01% | |

| AMP Notice Account | 0.10% | Minimum 31 days notice |

| ANZ Premium | 0.25% | |

| ANZ Progress Saver | 0.25% | Minimum $10 deposit and no withdrawal per month |

| Arab Bank Online Savings | 0.50% | Minimum balance $500,000. |

| Bankwest Smart eSaver | 0.25% | On balances from $500,000 to $5,000,000. No withdrawal per month |

| BOQ Fast Track Saver | 0.05% | Minimum monthly balance of $5000. |

| BoQ Bonus Interest Savings | 0.40% | Maximum 1 withdrawal per month. |

| CBA NetBank Saver | 0.05% | |

| CBA Goal Saver Account | 0.25% | On balances of $250,000 - $999,999. Minimum $200 deposit and no withdrawal per month. |

| Great Southern Bank | 0.35% | No maximum balance |

| Heritage Online Saver | 0.25% | Minimum balance $250,000 |

| ING Savings Accelerator | 0.75% | Minimum balance $150,000 |

| Macquarie CMA | 0.00% | Minimum balance $5000 |

| ME Online Savings | 0.05% | |

| NAB iSaver | 0.05% | |

| NAB Reward Saver | 0.25% | 1 deposit and no withdrawal per month |

| RAMS Saver Account | 0.15% | On balances from $200 - $500,000. Minimum $200 deposit and no withdrawal per month |

| Suncorp Growth Saver | 0.05% | |

| UBank USaver | 0.70% | Limit $200,000. Minimum $200 deposit per month. |

| UBank USaver Ultra | 0.05% | Limit $200,000. Minimum $200 deposit per month. |

| Up Saver Account | 1.05% | Calculated daily, paid monthly once qualfied |

| Volt Bank | 0.90% | Limit $245,000 |

| Westpac eSaver | 0.05% | |

| Westpac Reward Saver | 0.15% | Minimum $50 deposit and no withdrawal per month |

| 86400 Save account | 1.20% | On balances upto $50,000 |