Summary:

This week’s rise across the yield curve signals a market cautiously adjusting to the Reserve Bank of Australia (RBA)’s decision to hold the cash rate at 3.85% and the global fiscal boost from the “One Big Beautiful Bill” (OBBBA). The 1-month and 3-month BBSW held steady to 3.585% and 3.583%, reflecting tentative optimism amid the tariff deadline extension to August 1 and a quiet US market over the weekend.

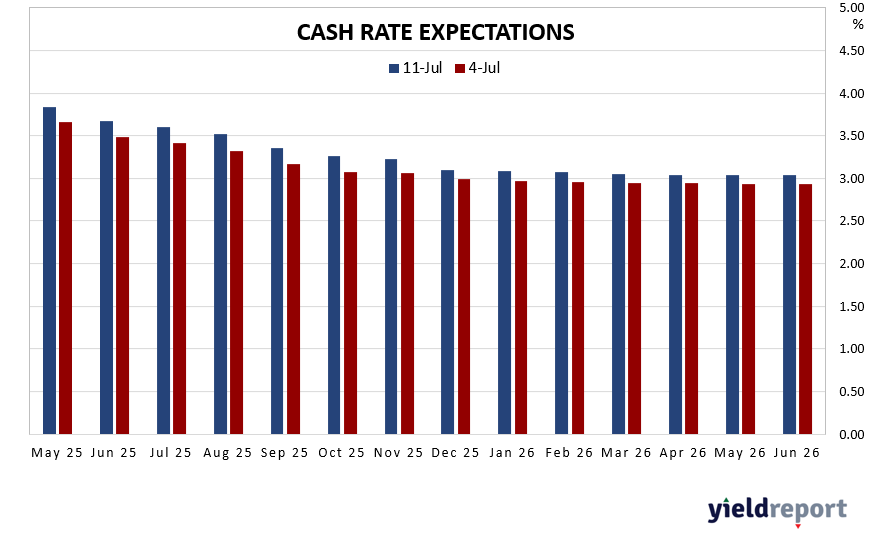

Markets are now pricing in a 100 basis points rate cut over the next 12 months, targeting a cash rate of 2.85% by mid-2026, down from the current 3.85%. This adjustment follows softer May CPI data at 2.1% year-on-year, reinforcing cut expectations. However, the RBA’s holds and forecasts from ANZ (3.35% by year-end 2025) and NAB (3.10% by early 2026), suggest a more conservative 75-100 basis point range. Investors remain in a wait-and-see mode, monitoring trade negotiations and the OBBBA’s $3.3 trillion impact.

Figure 1: Swaps on RBA Rate Cuts

| Product | Interest Rate p.a. | Notes |

|---|---|---|

| AMP Saver Account | 4.70% | Up to 4.70% pa variable rate on balances up to $500,0001. Applies for customers that meet the eligibility criteria. |

| ANZ Premium | 0.05% | $10,000 - $249,999 |

| ANZ Progress Saver | 3.50% | Make at least one deposit of $10 or more in a month, make no withdrawals (including transfers), or incur any fees, charges in the month. |

| Arab Bank Online Savings | 4.25% | On balances of $250,000 to $499,999 |

| Bankwest Hero Saver | 4.10% | Variable Hero rate on eligible balances up to $250,000.99.# |

| BOQ Fast Track Saver | 2.25% | ($1,000 deposited + 5 eligible transactions for per month) |

| BoQ Bonus Interest Savings | 5.10% | Bonus interest is paid into your account when you limit your withdrawals to a maximum of one per month |

| CBA NetBank Saver | 4.65% | 1.90% p.a. standard variable rate, 2.75% p.a. fixed bonus margin for the first 5 months on your first NetBank Saver |

| CBA Goal Saver Account | 4.45% | 0.30% p.a. standard variable rate,4.15% p.a. bonus variable interest rate |

| Great Southern Bank | 5.64% | Owner occupier, principal & interest, LVR 70% or less. Includes discount on new and additional lending. Min. loan amount applies |

| Heritage Online Saver | 4.35% | Manage your savings online with our high interest savings account. Plus, get a 4 month Bonus Intro Rate* available for new members on balances up to $100,000. |

| ING Savings Accelerator | 4.95% | from 9 June 2025 and roll higher with our 4.95% p.a. variable kick starter offer.This includes a 0.75% p.a. variable kick starter rate for the first 4 months on balances up to $500,000. After that, roll on with our 4.20% p.a. variable ongoing rate. |

| Macquarie CMA | 2.25% | Minimum $5,000 |

| ME Online Savings | 3.85% | Bonus interest applies to balances up to $500,000. |

| NAB iSaver | 4.65% | This is the total rate (standard variable rate plus fixed bonus margin rate) you could earn for the first four months, if you have not held a NAB iSaver in the last 12 months (on balances up to $20 million). |

| NAB Reward Saver | 4.35% | This is the total rate (variable base rate + variable bonus rate) you could earn on your NAB Reward Saver account if you meet the variable bonus rate conditions. |

| Rabobank PremiumSaver | 4.80% | On balances to $250,000. Balance increased by $200 a month. |

| RAMS Saver Account | 1.40% | On balances to $500,000. Minimum $200 deposit each month with no withdrawals. |

| Suncorp Growth Saver | 4.55% | Minimum $200 deposit each month and no more than 1 withdrawal |

| ubank Save Account | 4.85% | 5.5% on first $100,000, 5.0% on next $150,000; applies only on amounts upto $250,000. Minimum $500 deposit each month into Spend or Save accounts. |

| Up Savers Account | 4.35% | Make 5 successful purchases using your Up or 2Up debit card or digital wallets in a month. |

| Westpac eSaver | 4.50% | 3.15% p.a. for the first 5 months for new Westpac eSaver customers |

| Westpac Reward Saver | 4.50% | Make a deposit to the account and ensure account balance is higher at the end of the month than the beginning. Keep your account balance above $0 at all times. |