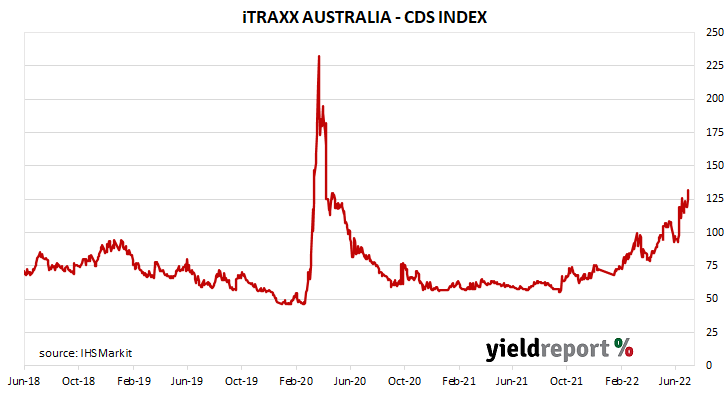

Summary: Corporate bond spreads about 1bp wider on average; swap spreads wider; iTraxx up 3 points; S&P downgrades EnergyAustralia Holdings, QIC Property Fund.

Corporate spreads finished the week about 1bp wider on average as corporate yields almost kept pace with falls of their Commonwealth counterparts. The majority of spreads’ week-on-week changes at the individual level were within a range of -2bps to +10bps, although a few bonds close to maturity had spreads which moved by greater amounts.

One of the two other main measures of corporate risk, swap-to-bond spreads, widened considerably along the curve. However, the other measure, credit default swap premiums, increased. The Australian credit default swap index, the iTraxx Australia Series 37, finished 3.00 points higher at 135.00 points.

In ratings news, S&P downgraded EnergyAustralia Holdings Ltd from BBB+ to BBB- and revised its outlook to “negative” in response to unplanned outages and an exposure to higher wholesale prices.

S&P also downgraded QIC Property Fund from A to BBB+ (stable) from A after QIC changed the fund’s gearing policy.

Interested readers can find the week’s bond transactions in our tables via the link below.

| ISSUER | MATURITY | COUPON (%) | RATING | WEEK HIGH | WEEK LOW | CLOSING YIELD | Δ WEEK | Δ MONTH |

|---|---|---|---|---|---|---|---|---|

| GE Capital | 8-Aug-22 | 5.50 | BBB+ | 2.07 | 2.06 | 2.07 | 0.01 | 0.39 |

| Optus | 23-Aug-22 | 3.25 | A | 2.03 | 1.94 | 2.03 | 0.12 | 0.36 |

| Apple Inc | 28-Aug-22 | 3.70 | AA+ | 1.91 | 1.88 | 1.91 | 0.01 | 0.39 |

| Wells Fargo | 7-Sep-22 | 5.25 | A- | 2.35 | 2.31 | 2.35 | 0.05 | 0.42 |

| Melbourne Airport | 15-Sep-22 | 4.00 | BBB+ | 2.34 | 2.22 | 2.34 | 0.21 | 0.77 |

| Telstra | 16-Sep-22 | 4.00 | A | 2.50 | 2.40 | 2.50 | 0.12 | 0.61 |

| Stockland | 23-Nov-22 | 4.50 | A- | 2.41 | 2.16 | 2.41 | 0.26 | 0.41 |

| ANZ | 16-Aug-23 | 5.00 | AA- | 3.71 | 3.62 | 3.71 | 0.10 | 0.48 |

| Transpower NZ | 28-Aug-23 | 5.75 | AA- | 3.61 | 3.46 | 3.61 | 0.16 | 0.43 |

| Mirvac Finance | 18-Sep-23 | 3.50 | BBB+ | 3.91 | 3.76 | 3.91 | 0.16 | 0.45 |

| Qantas | 10-Oct-23 | 4.40 | BB+ | 4.50 | 4.35 | 4.50 | 0.15 | 0.25 |

| Australia Post | 13-Nov-23 | 5.50 | A+ | 3.67 | 3.55 | 3.67 | 0.13 | 0.36 |

| Westpac | 21-Nov-23 | 4.40 | AA- | 3.78 | 3.69 | 3.78 | 0.07 | 0.34 |

| Fonterra | 26-Feb-24 | 5.50 | A- | 4.12 | 3.97 | 4.12 | 0.12 | 0.35 |

| NAB | 11-Mar-24 | 5.00 | AA- | 3.83 | 3.72 | 3.83 | 0.05 | 0.19 |

| Rabobank Nederland (Aust) | 11-Apr-24 | 5.50 | A+ | 4.03 | 3.92 | 4.03 | 0.04 | 0.29 |

| CBA | 27-May-24 | 4.75 | AA- | 4.00 | 3.86 | 4.00 | 0.11 | 0.24 |

| AusNet | 21-Jun-24 | 4.00 | BBB+ | 4.58 | 4.45 | 4.58 | 0.09 | 0.28 |

| Macquarie Bank | 7-Aug-24 | 1.75 | A+ | 4.27 | 4.16 | 4.27 | 0.04 | 0.16 |

| Wells Fargo | 27-Aug-24 | 4.75 | A+ | 4.55 | 4.44 | 4.55 | 0.01 | 0.30 |

| University of Sydney | 28-Aug-25 | 3.75 | Aa1 | 4.07 | 3.89 | 4.07 | 0.03 | 0.12 |

| Apple Inc | 10-Jun-26 | 3.60 | AA+ | 4.27 | 4.14 | 4.27 | -0.03 | 0.14 |

| CBA | 11-Jun-26 | 4.20 | AA- | 4.31 | 4.18 | 4.31 | -0.02 | 0.03 |

| ANZ | 22-Jul-26 | 4.00 | AA- | 4.39 | 4.26 | 4.39 | -0.01 | 0.08 |

| Qantas | 12-Oct-26 | 4.75 | BB+ | 5.49 | 5.34 | 5.49 | 0.02 | 0.09 |

| Australia Pacific Airports | 4-Nov-26 | 3.75 | BBB+ | 4.99 | 4.85 | 4.99 | 0.05 | 0.17 |

| CBA | 17-Nov-26 | 3.25 | AA- | 4.32 | 4.23 | 4.32 | -0.02 | 0.11 |

| Australia Post | 1-Dec-26 | 4.00 | A+ | 4.30 | 4.17 | 4.30 | -0.02 | 0.09 |

| WSO Finance | 31-Mar-27 | 4.50 | A- | 4.88 | 4.73 | 4.88 | 0.03 | 0.17 |

| Telstra | 19-Apr-27 | 4.00 | A | 4.71 | 4.57 | 4.71 | 0.04 | 0.20 |

| Vicinity Centre | 26-Apr-27 | 4.00 | A | 5.10 | 4.98 | 5.10 | 0.05 | 0.23 |

| Dexus Finance | 11-May-27 | 4.25 | A3 | 4.88 | 4.76 | 4.88 | 0.04 | 0.23 |

| Asciano | 12-May-27 | 5.40 | BBB- | 6.00 | 5.88 | 6.00 | 0.04 | 0.14 |

| Fonterra | 2-Nov-27 | 4.00 | A- | 4.82 | 4.68 | 4.82 | -0.01 | 0.15 |

| Macquarie | 15-Dec-27 | 4.15 | BBB+ | 5.49 | 5.33 | 5.49 | 0.00 | 0.36 |

| AusNet | 21-Aug-28 | 4.20 | A- | 5.65 | 5.52 | 5.65 | 0.00 | 0.36 |