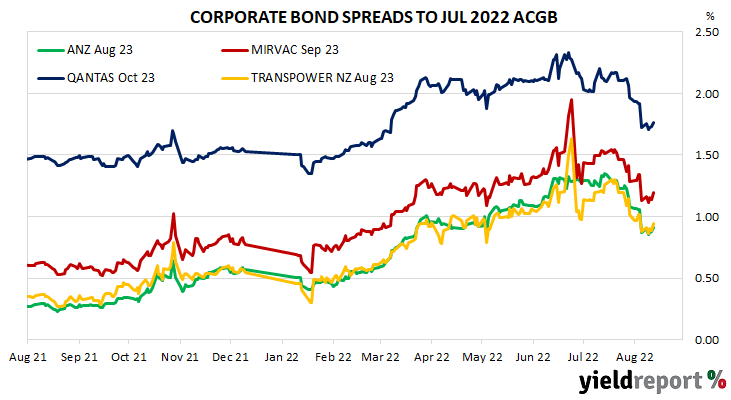

Summary: Corporate bond spreads about 6bps wider on average; swap spreads narrow; iTraxx down 11.80 points; issuance volume subsides.

Corporate spreads finished the week about 6bps wider on average as corporate yields generally outpaced the rises of their Commonwealth counterparts. The majority of spreads’ week-on-week changes at the individual level were within a range of -3bps to +11bps and the more notable exceptions included Australia Post November 2023s (spread: 94bps, -9bps) and Macquarie Bank (spread: 122bps, -8bps).

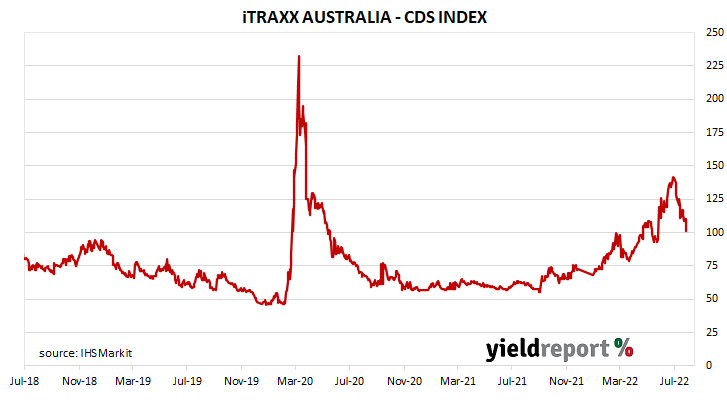

One of the two other main measures of corporate risk, swap-to-bond spreads, narrowed along its curve. The other measure, credit default swap premiums, decreased again. The Australian credit default swap index, the iTraxx Australia Series 37, finished 11.80 points lower at 97.20 points.

Volumes in the primary market for corporate bonds and notes subsided despite a large, four-tranche sale of bonds from Commonwealth Bank. $5.0 billion worth of bonds or notes were priced by local entities or their subsidiaries, whereas in the previous week issuance amounted to $8.3 billion. There was one asset-backed transaction which accounted for $300 million of the $5.0 billion .

Interested readers can find the week’s bond transactions in our tables via the link below.

| ISSUER | MATURITY | COUPON (%) | RATING | WEEK HIGH | WEEK LOW | CLOSING YIELD | Δ WEEK | Δ MONTH |

|---|---|---|---|---|---|---|---|---|

| Optus | 23-Aug-22 | 3.25 | A | 2.26 | 2.20 | 2.26 | 0.13 | 0.23 |

| Apple Inc | 28-Aug-22 | 3.70 | AA+ | 2.08 | 2.03 | 2.08 | 0.06 | 0.17 |

| Wells Fargo | 7-Sep-22 | 5.25 | A- | 2.46 | 2.44 | 2.45 | 0.08 | 0.10 |

| Melbourne Airport | 15-Sep-22 | 4.00 | BBB+ | 2.53 | 2.44 | 2.53 | 0.17 | 0.20 |

| Telstra | 16-Sep-22 | 4.00 | A | 2.54 | 2.46 | 2.54 | 0.12 | 0.04 |

| Stockland | 23-Nov-22 | 4.50 | A- | 2.49 | 2.32 | 2.49 | 0.30 | 0.08 |

| ANZ | 16-Aug-23 | 5.00 | AA- | 3.77 | 3.62 | 3.77 | 0.28 | 0.06 |

| Transpower NZ | 28-Aug-23 | 5.75 | AA- | 3.80 | 3.63 | 3.80 | 0.30 | 0.19 |

| Mirvac Finance | 18-Sep-23 | 3.50 | BBB+ | 4.05 | 3.88 | 4.05 | 0.30 | 0.14 |

| Qantas | 10-Oct-23 | 4.40 | BB+ | 4.62 | 4.47 | 4.62 | 0.28 | 0.12 |

| Australia Post | 13-Nov-23 | 5.50 | A+ | 3.81 | 3.71 | 3.81 | 0.17 | 0.14 |

| Westpac | 21-Nov-23 | 4.40 | AA- | 3.86 | 3.74 | 3.86 | 0.26 | 0.08 |

| Fonterra | 26-Feb-24 | 5.50 | A- | 4.17 | 4.02 | 4.17 | 0.29 | 0.06 |

| NAB | 11-Mar-24 | 5.00 | AA- | 3.96 | 3.79 | 3.96 | 0.31 | 0.13 |

| Rabobank Nederland (Aust) | 11-Apr-24 | 5.50 | A+ | 4.05 | 3.90 | 4.05 | 0.29 | 0.02 |

| CBA | 27-May-24 | 4.75 | AA- | 4.05 | 3.89 | 4.05 | 0.29 | 0.05 |

| AusNet | 21-Jun-24 | 4.00 | BBB+ | 4.61 | 4.44 | 4.61 | 0.31 | 0.04 |

| Macquarie Bank | 7-Aug-24 | 1.75 | A+ | 4.25 | 4.16 | 4.23 | 0.20 | -0.04 |

| Wells Fargo | 27-Aug-24 | 4.75 | A+ | 4.60 | 4.40 | 4.60 | 0.33 | 0.05 |

| University of Sydney | 28-Aug-25 | 3.75 | Aa1 | 4.14 | 3.93 | 4.14 | 0.36 | 0.07 |

| Apple Inc | 10-Jun-26 | 3.60 | AA+ | 4.23 | 4.03 | 4.23 | 0.34 | -0.04 |

| CBA | 11-Jun-26 | 4.20 | AA- | 4.31 | 4.08 | 4.31 | 0.37 | 0.00 |

| ANZ | 22-Jul-26 | 4.00 | AA- | 4.34 | 4.10 | 4.34 | 0.38 | -0.05 |

| Qantas | 12-Oct-26 | 4.75 | BB+ | 5.47 | 5.25 | 5.47 | 0.37 | -0.01 |

| Australia Pacific Airports | 4-Nov-26 | 3.75 | BBB+ | 4.98 | 4.81 | 4.98 | 0.32 | -0.01 |

| CBA | 17-Nov-26 | 3.25 | AA- | 4.34 | 4.09 | 4.34 | 0.39 | 0.02 |

| Australia Post | 1-Dec-26 | 4.00 | A+ | 4.28 | 4.06 | 4.28 | 0.32 | -0.02 |

| WSO Finance | 31-Mar-27 | 4.50 | A- | 4.83 | 4.61 | 4.83 | 0.35 | -0.05 |

| Telstra | 19-Apr-27 | 4.00 | A | 4.58 | 4.40 | 4.58 | 0.32 | -0.13 |

| Vicinity Centre | 26-Apr-27 | 4.00 | A | 5.08 | 4.88 | 5.08 | 0.33 | -0.02 |

| Dexus Finance | 11-May-27 | 4.25 | A3 | 4.82 | 4.62 | 4.82 | 0.33 | -0.06 |

| Asciano | 12-May-27 | 5.40 | BBB- | 5.90 | 5.75 | 5.90 | 0.30 | -0.10 |

| Fonterra | 2-Nov-27 | 4.00 | A- | 4.72 | 4.50 | 4.72 | 0.35 | -0.10 |

| Macquarie | 15-Dec-27 | 4.15 | BBB+ | 5.40 | 5.22 | 5.40 | 0.31 | -0.09 |

| AusNet | 21-Aug-28 | 4.20 | A- | 5.54 | 5.29 | 5.54 | 0.37 | -0.10 |