The physical bank bill rate and 3 month BBSW both increased by 5bps from 2.06% to 2.11%.

Swap rates generally lagged their Commonwealth benchmarks as rates/yields generally fell. The 1 year swap rate was an exception and it increased by 3bps to 2.03% while swap rate further along the curve fell. The 3 year rate slipped by 2bps to 2.18%, 5 year rates decreased by 2bps to 2.53% and 10 year and 15 year rates both slipped by 2bps to 2.85% and 3.02% respectively.

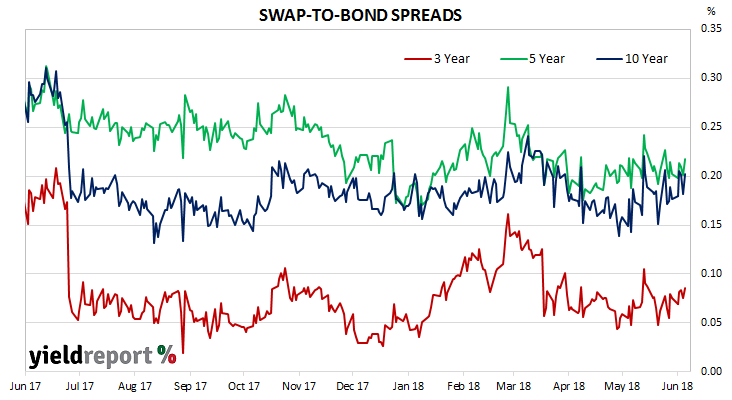

As a result, swap-to-bond spreads increased by 1-2bps. The 3 year spread added 1bp from 8bps to 9bps, the 5 year spread widened from 20bps to 22bps and the 10 year spread also increased by 2bps to 20bps.

AFMA BBSW - SWAP RATES

| TERM TO MATURITY | Closing Rate | Δ WEEK | Δ MONTH |

|---|---|---|---|

| 30 Day | 2.00 | 0.08 | 0.16 |

| 90 Day | 2.11 | 0.05 | 0.18 |

| 180 Day | 2.22 | 0.06 | 0.18 |

| 1 Year | 2.03 | 0.03 | 0.08 |

| 3 Year | 2.18 | -0.02 | -0.04 |

| 5 Year | 2.52 | -0.03 | -0.08 |

| 10 Year | 2.85 | -0.02 | -0.09 |

| 15 Year | 3.02 | -0.02 | -0.10 |