Summary: ACGB curve flatter; US Treasury curve generally more negative.

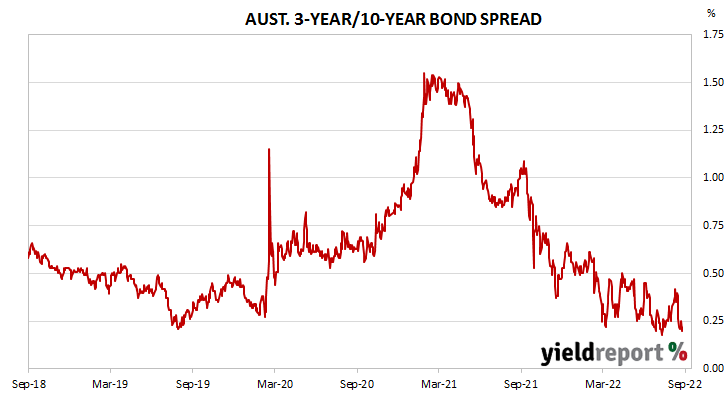

The gradient of the ACGB yield curve became flatter as yields rose again. By the end of the week, the 3-year/10-year spread had returned to its starting point at 22bps* while the 3/20 year spread had lost 4bps to 44bps.

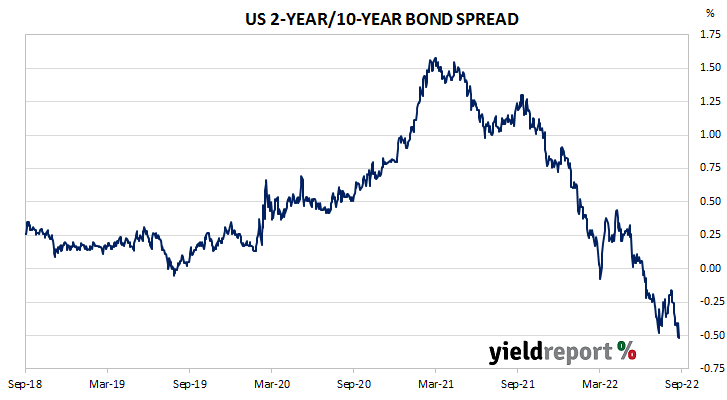

The various measures of the gradient of the US Treasury curve generally became more negative. The 2-year/10-year spread lost 11bps to -52bps over the week while the 2 year/30 year spread shed 26bps to -60bps. However, the 3-month/10-year Treasury spread, finished 19bps wider at +50bps.

To find out more about the yield curve and its usefulness, click here or here.